Fact Sheet

Optimizing State Spending

Summary

- Pennsylvania faces a $3.6 billion structural budget deficit in Fiscal Year (FY) 2024–25. The Independent Fiscal Office (IFO) calculates Gov. Josh Shapiro’s FY 2025–26 budget proposal would increase the deficit to $6 billion and deplete the Rainy Day Fund to cover ongoing overspending.

- Lawmakers must control spending growth to bring the budget closer to balance and protect Pennsylvania families from multibillion-dollar tax increases. This means optimizing state spending, prioritizing economic growth, and rejecting spending increases.

- Ending corporate welfare subsidies and using the savings to cut taxes could save the average Pennsylvania family of four $508 annually or reduce the Corporate Net Income Tax by 2.65 percentage points.

- Pennsylvania has over one hundred “Other Special Funds,” many of which have significant cash balances. Reducing fund balances to a maximum of one year of expenditures and freezing fund balance increases would allow the state to draw an estimated $2.89 billion.

Corporate Welfare

- Shapiro’s FY 2025–26 budget proposal plans $1.6 billion in corporate welfare spending, a $51 million hike over last year.

- Shapiro’s proposal would eliminate five corporate welfare tax credit programs while adding new programs for two tax credits and four grants.

- These targeted corporate welfare programs are ineffective. An IFO review found that most tax credits return less than 25 cents per dollar invested. A $2.6 billion tax credit package passed in 2022 created four never-used tax credit programs.

- Grant and loan programs are also ineffective and suffer from bureaucratic roadblocks. For example, allocation benchmarks—set by the Pennsylvania Liquor Control Board—stopped reimbursements on approximately 20 percent of dollars awarded for a beer grant program.

- Even when businesses receive state grants, there is no guarantee of success or return on investment. Recently, a lunar lander project that received $4 million in state funds suffered a critical failure, destroying the lander.

- Low-tax, economically competitive states attract more businesses and residents. Cutting all corporate welfare spending and applying the cost savings toward rate reductions to the Corporate Net Income Tax (CNIT) and/or Personal Income Tax (PIT) is a more effective way to improve Pennsylvania’s economic competitiveness.

- Cutting $1.6 billion in corporate welfare spending could instantly reduce the CNIT by 2.35 percentage points. With this reduction, Pennsylvania’s CNIT rate would reach 6.14 percent, slightly better than the national average.

- Likewise, the cost savings could instantly reduce the PIT to 2.80 percent and save the average family of four $508 annually.

Special Funds

The state budget includes over one hundred “Other Special Funds.” From 2000 to 2024, these funds have grown by over 300 percent, compared to 140 percent growth in the General Fund. Additionally, many of these funds hold significant cash reserves. Lawmakers should evaluate the necessity of these shadow spending programs and utilize unreasonable cash balances toward balancing the budget.

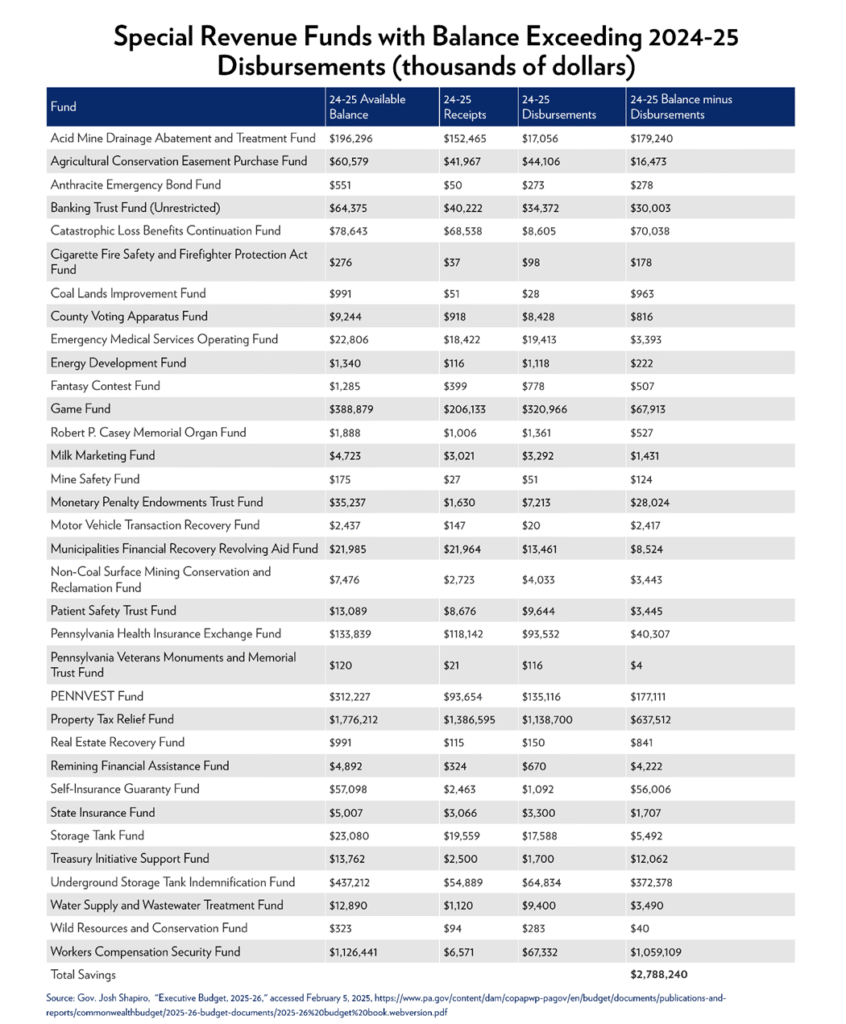

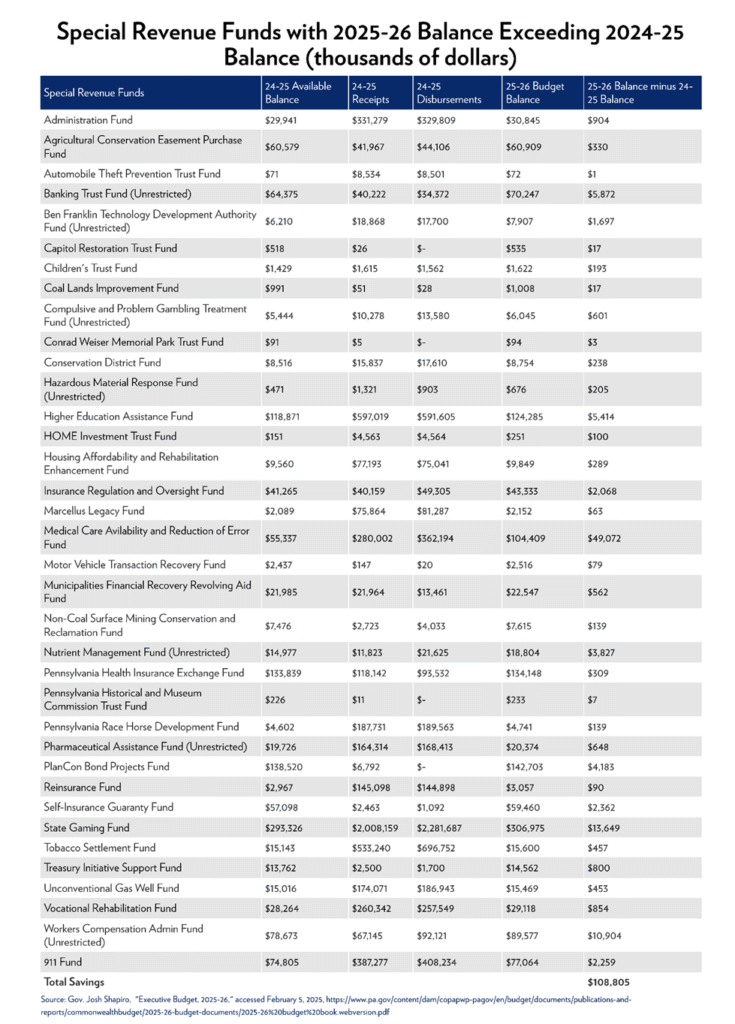

- The Commonwealth Foundation identified 61 special revenue funds (excluding the Rainy Day Fund and federal holding funds) where FY 2024–25 unrestricted cash balances exceeded annual disbursements, and/or unrestricted cash balances were projected to grow in FY 2025–26.

- These 61 funds hold a combined $5.7 billion in unrestricted cash balances. The state could draw an estimated $2.89 billion by reducing excess special revenue fund balances to match one year of disbursements and freezing fund balance increases in FY 2025–26.

- Lawmakers should also evaluate the state’s enterprise funds and fiduciary funds to ensure these funds serve their intended purpose and have appropriate balances.

- For example, the Liquid Fuels Tax Fund, Liquor License Fund, and State Stores Fund receive a set amount of annual receipts. These funds are required to make set disbursements to different departments and programs yet hold a combined $214.9 million in cash balances.

Other Ways to Optimize the Budget

- Lawmakers must reject unnecessary spending increases for education and mass transit, and focus funding on students and riders, not systems.

- State support of public schools continues to increase despite declining enrollment, poor return on investment, and flush reserves. Shapiro’s budget proposal adds $824 million to public education funding. Private schools serving tax credit scholarship recipients educate students at an average annual tuition of $5,598, a fraction of the nearly $22,000 per student spent in public education. Across the country, school choice programs, such as the proposed Lifeline Scholarship Program, generate between $1.80 and $2.85 in cost savings per dollar spent.

- Mass transit agencies received $2.47 billion in state funding during FY 2024–25 and are already overly reliant on state funding compared to similar-sized agencies. These systems should increase fares and reevaluate services rather than receive more state funding.

- Lawmakers should adopt welfare reforms and privatize government-run businesses.

- Enacting work and community requirements for able-bodied adults on Medicaid and increasing the frequency of eligibility reviews to ensure the program serves only eligible Pennsylvanians.

- Privatizing liquor sales. Past analysis on liquor privatization has shown potential cost savings with the added benefit of lower prices and increased consumer choice.

- Lawmakers should take proactive steps to safeguard the state and taxpayers from future deficits.

- Establishing the Taxpayer Protection Act to limit spending growth to the rate of inflation and population growth, ensuring that spending grows in line with taxpayers’ ability to pay.

- Closing a loophole that allows budgets with an inaccurate revenue estimate or without the governor’s signature to become law.

- Protecting Pennsylvania’s Budgetary Stabilization Reserve Fund, or Rainy Day Fund, from illegal draws to balance the budget is vital to the state’s fiscal health and stability. State law reserves its use as an essential one-time revenue source to compensate for emergencies or economic downturns.