Latest Content

Education

What You Need to Know About Pennsylvania’s 2025-26 State Budget

Summary Four months late, Gov. Josh Shapiro and state lawmakers agreed on a state budget deal. The agreement spends $1.4 billion less than Shapiro’s reckless, extreme proposal, and uses excessive…

Read More: What You Need to Know About Pennsylvania’s 2025-26 State Budget

Education

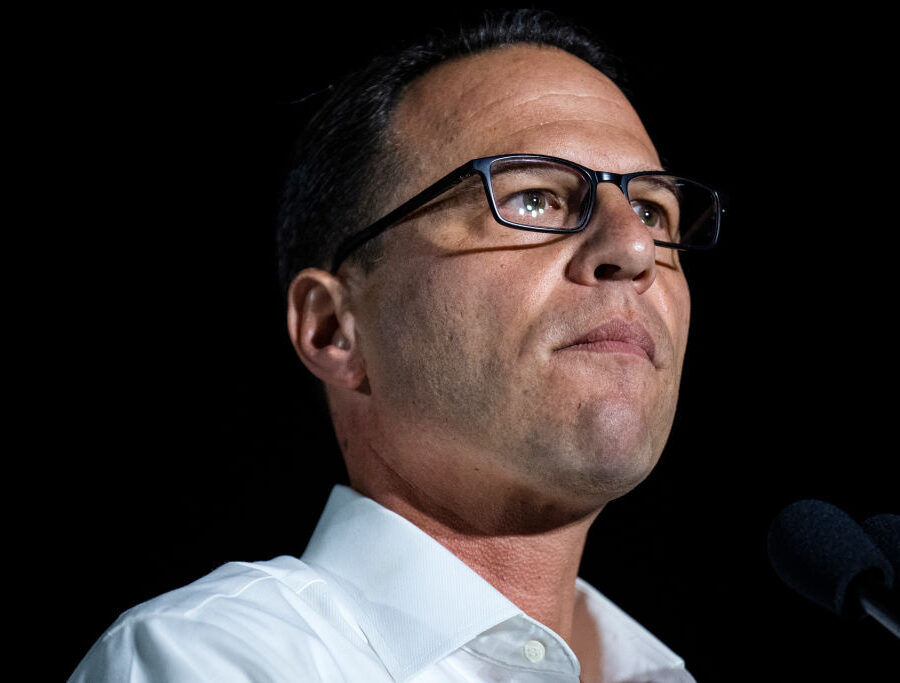

Josh Shapiro: Least Productive Pennsylvania Governor in at Least 50 Years

Read More: Josh Shapiro: Least Productive Pennsylvania Governor in at Least 50 Years

Education

Low-Achieving and Violent Public Schools in Pennsylvania

Read More: Low-Achieving and Violent Public Schools in Pennsylvania

Myths and Facts: Public Cyber Charter Schools

Read More: Myths and Facts: Public Cyber Charter SchoolsState Budget

Corporate Welfare in Governor Shapiro’s Fiscal Year 2025–26 Budget Proposal

Summary Pennsylvania’s economy lags behind other states, hindered by high taxes and burdensome regulations. As a result, the state suffers from continued outmigration, with residents leaving for better opportunities in…

Fact Sheet

Read More: Corporate Welfare in Governor Shapiro’s Fiscal Year 2025–26 Budget ProposalEducation

Rethinking School District Reserve Funds as Students Return to Class

Pennsylvania must focus on funding students. Overview After years of property tax hikes and significant increases in state funding, Pennsylvania school districts ended the 2023–24 school year with more than…

Backgrounder

Read More: Rethinking School District Reserve Funds as Students Return to ClassTaxes & Economy

Minimum Wage

Summary Findings by the Pennsylvania Department of Labor and Industry (L&I) show that less than one percent of Pennsylvania workers (47,200) earn the minimum wage or…

Fact Sheet

Read More: Minimum WageEducation

Persistently Dangerous Pennsylvania Public Schools

Calculating danger based only on arrests ignores student safety. Overview New analysis by the Commonwealth Foundation shows that Pennsylvania violates state and federal law by failing to identify persistently dangerous…

Backgrounder

Read More: Persistently Dangerous Pennsylvania Public SchoolsEducation

One Big, Beautiful Bill Benefits for Pennsylvanians

Summary On July 4, 2025, President Donald Trump signed House Resolution 1, better known as the “One Big, Beautiful Bill Act” (OBBB), into law. Within the…

Fact Sheet

Read More: One Big, Beautiful Bill Benefits for PennsylvaniansEducation

Educational Choice for Children Act

U.S. Congress expands educational opportunity for K–12 students nationwide, funding millions in tax credit scholarships for Pennsylvania kids. First-Ever Federal Tax Credit Scholarship Program The U.S. Congress passed the Educational…

Fact Sheet

Read More: Educational Choice for Children ActEnergy

Shapiro’s Lights Out Agenda

Analysis of Governor Shapiro’s Lightning Plan Summary In January, Gov. Josh Shapiro unveiled his Lightning Plan, which he calls a “bold, all-of-the-above energy plan” to shift…

Fact Sheet

Read More: Shapiro’s Lights Out AgendaEducation

Learning Investment Tax Credit

Summary The proposed Learning Investment Tax Credit (LITC), House Bill (HB) 1662, creates a $8,000 per child refundable tax credit to offset education expenses if parents choose a non-public…

Fact Sheet

Read More: Learning Investment Tax CreditHealth Care

How Welfare Reforms in the OBBB Protect Pennsylvanians

Summary Medicaid and the Supplemental Nutrition Assistance Program (SNAP), commonly known as Food Stamps, were intended to help provide health insurance and food for low-income seniors,…

Fact Sheet

Read More: How Welfare Reforms in the OBBB Protect PennsylvaniansState Budget

Deficit Watch: June 2025

Lawmakers must protect the Rainy Day Fund. Background Pennsylvania faces serious fiscal challenges. The enacted 2024–25 General Fund budget created a $3.6 billion structural deficit. Gov. Josh Shapiro’s 2025–26…

Deficit Watch

Read More: Deficit Watch: June 2025Education

HB 1500 Harms Cyber School Students

Summary Pennsylvania public school revenue has risen by almost 5 percent in the last year to more than $23,000 per student. The commonwealth ranks seventh in the nation in spending…

Fact Sheet

Read More: HB 1500 Harms Cyber School StudentsEnergy

Preventing Pennsylvania from Powering Down: Analysis of Governor Shapiro’s PACER and PRESS Proposals

Key Findings The Price Tag: Governor Shapiro’s Pennsylvania Climate Emissions Reduction Act (PACER) and Pennsylvania Reliable Energy Sustainability Standard (PRESS) proposals would impose $157.2 billion in new electricity costs on…

Report

Read More: Preventing Pennsylvania from Powering Down: Analysis of Governor Shapiro’s PACER and PRESS ProposalsEducation

Educational Choice Myth and Facts 2025

Summary Unfortunately, conversations about education choice are fraught with myths about accountability, funding, and who qualifies for choice programs. This fact sheet addresses the most common myths. Academic Accountability MYTH:School…

Fact Sheet

Read More: Educational Choice Myth and Facts 2025Education

Pennsylvania School Funding Reaches $23,000 per Student in 2024

Pennsylvania Public School Spending is Growing Public school spending reaches historic levels year after year. Pennsylvania public school revenue per student increased to $23,061 in the 2023-24 school year, up…

Fact Sheet

Read More: Pennsylvania School Funding Reaches $23,000 per Student in 2024Education

PASS/Lifeline Scholarship Program

Overview Two proposals—Senate Bill 10, the Pennsylvania Award for Student Success Scholarship Program (PASS), and forthcoming Lifeline Scholarship legislation in the Pennsylvania House of Representatives—are separate but similar…

Fact Sheet

Read More: PASS/Lifeline Scholarship Program

Find Your School District’s Reserves

Local Districts: Charter Schools:…

Research

Read More: Find Your School District’s ReservesState Budget

Deficit Watch: May 2025

Pennsylvania cannot afford more mass transit bailouts. Background Pennsylvania faces serious fiscal challenges. The enacted 2024–25 General Fund budget created a $3.6 billion structural deficit. Gov.

Deficit Watch

Read More: Deficit Watch: May 2025State Budget

EITC and Economically Disadvantaged Schools

Summary The Economically Disadvantaged School (EDS) component of the Educational Improvement Tax Credit (EITC) scholarship program provides supplementary scholarships for Pennsylvania students, who are economically disadvantaged and attend private schools…

Fact Sheet

Read More: EITC and Economically Disadvantaged SchoolsState Budget

Mass Transit Bailout

2025 Budget Proposal Seeks to Further Subsidize Inefficient Agencies Summary Mass transit agencies, including Southeastern Pennsylvania Transportation Authority (SEPTA) in Philadelphia and Pittsburgh Regional Transit (PRT) in Pittsburgh, have seen…

Fact Sheet

Read More: Mass Transit BailoutRegulation

Portable Benefits for Gig-Workers

Findings from a DoorDash pilot program in Pennsylvania. Summary In April 2024, with the support of Gov. Josh Shapiro, DoorDash launched a first-of-its-kind portable benefits six-month pilot program for…

Fact Sheet

Read More: Portable Benefits for Gig-WorkersPublic Union Democracy

Government Union Political Spending in Pennsylvania’s 2023–24 Election Cycle

Key Points Government unions enjoy a host of special legal privileges in Pennsylvania, which allow their executives to exert undue influence over Pennsylvania’s public policy process. Government union bosses use…

Backgrounder

Read More: Government Union Political Spending in Pennsylvania’s 2023–24 Election Cycle