Latest Content

Education

What You Need to Know About Pennsylvania’s 2025-26 State Budget

Summary Four months late, Gov. Josh Shapiro and state lawmakers agreed on a state budget deal. The agreement spends $1.4 billion less than Shapiro’s reckless, extreme proposal, and uses excessive…

Read More: What You Need to Know About Pennsylvania’s 2025-26 State Budget

Education

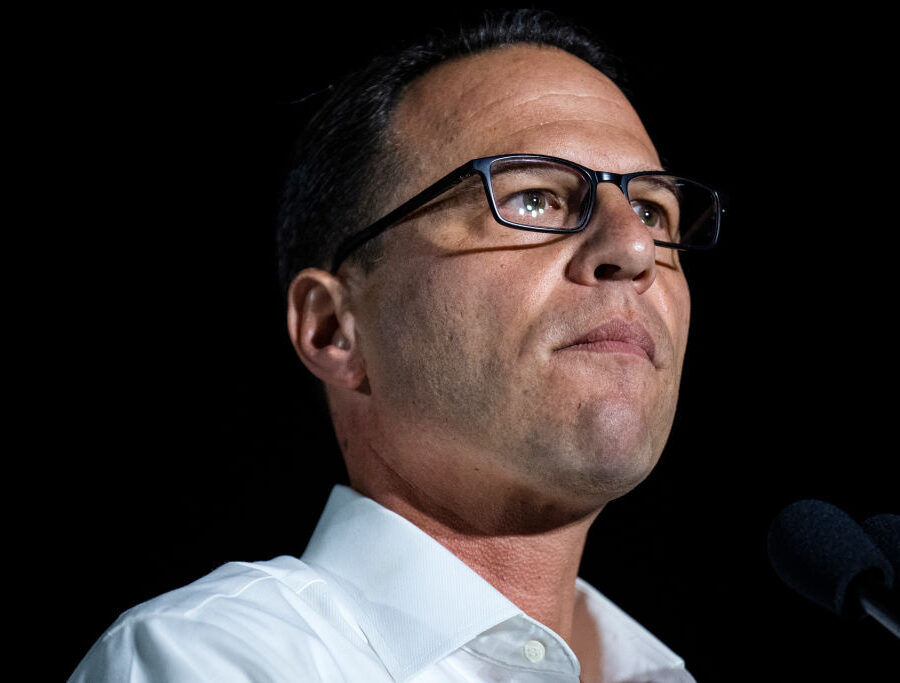

Josh Shapiro: Least Productive Pennsylvania Governor in at Least 50 Years

Read More: Josh Shapiro: Least Productive Pennsylvania Governor in at Least 50 Years

Education

Low-Achieving and Violent Public Schools in Pennsylvania

Read More: Low-Achieving and Violent Public Schools in Pennsylvania

Myths and Facts: Public Cyber Charter Schools

Read More: Myths and Facts: Public Cyber Charter SchoolsGovernment Accountability

Persistent Leadership will Safely Reopen Pa.

Governor Wolf continues to take positive steps toward a safe and gradual opening of the Pennsylvania economy because lawmakers continue to advance good policy that protects lives and livelihoods.

Memo

Read More: Persistent Leadership will Safely Reopen Pa.Education

Emergency Education Scholarship Accounts

Educational impacts from COVID-19 will reverberate for years—particularly for students who are already struggling. Emergency ESAs can help stem learning losses and keep kids on a path to success.

Memo

Read More: Emergency Education Scholarship AccountsCriminal Justice Reform

How Pa. Can Keep Prisons and Communities Safe During Coronavirus

Pennsylvania’s prisons and jails are particularly vulnerable to the quick spread of COVID-19. Here are several recommendations for mitigating the risk in our corrections system while protecting public safety. …

Fact Sheet

Read More: How Pa. Can Keep Prisons and Communities Safe During CoronavirusEducation

Understanding Cyber Charter Schools

Misconceptions abound when it comes to cyber charter schools—and opponents use that confusion to attack this important option. In the current era of school shutdowns, it's more important than ever…

Fact Sheet

Read More: Understanding Cyber Charter SchoolsHealth Care

Policy Recommendations to Fight COVID-19 in Pennsylvania

As Pennsylvania faces its greatest crisis in decades, it is imperative that legislators take the lead and enact key heath care, education, and budget reforms to help Pennsylvania families and small…

Fact Sheet

Read More: Policy Recommendations to Fight COVID-19 in PennsylvaniaGovernment Accountability

Three Steps to an Honest Budget: Fiscal Reform Priorities 2020-2021

Our legislative roadmap to a balanced budget, a spending limit and a more transparent fiscal process.

Fact Sheet

Read More: Three Steps to an Honest Budget: Fiscal Reform Priorities 2020-2021Education

Tuition Scholarships for Harrisburg

With HB 1800, Speaker Mike Turzai (R-Allegheny) wants to give parents the ability to escape Harrisburg schools without a permission slip from local officials.

Fact Sheet

Read More: Tuition Scholarships for HarrisburgState Budget

Pa. Voters Support the Taxpayer Protection Act

Nearly 2/3rds of Pennsylvanians support the Taxpayer Protection Act.

Poll

Read More: Pa. Voters Support the Taxpayer Protection ActPublic Union Democracy

Pa. Voters Support the Employee Rights Notification Act

66% of voters support the Employee Rights Notification Act.

Poll

Read More: Pa. Voters Support the Employee Rights Notification ActHealth Care

The Administrative Cost of Community Engagement Requirements in Medicaid

This is the first in a series of policy briefs looking at the common objections to implementing community engagement requirements, or work expectations, for healthy adults receiving benefits under Medicaid…

Fact Sheet

Read More: The Administrative Cost of Community Engagement Requirements in MedicaidState Budget

Slicing Pennsylvania’s Finances, Part 2

The state legislature controls less than half of all state revenue. The rest is on autopilot, flowing automatically through a maze of accounts and undermining the constituional plan for accountabilty…

Fact Sheet

Read More: Slicing Pennsylvania’s Finances, Part 2Education

Fact Sheet: HB 1897 Eliminating Cyber Charter Schools

Today 34,000 Pennsylvania kids choose cyber charter schools. HB 1897 would eliminate all Pa. cyber charter schools by fall 2021. It also issues a top-down mandate that each school district…

Fact Sheet

Read More: Fact Sheet: HB 1897 Eliminating Cyber Charter SchoolsEducation

A Fair, Accountable, and Transparent Education

What are the facts on fairness, accountability, and transparency in the Commonwealth’s education system?…

Fact Sheet

Read More: A Fair, Accountable, and Transparent EducationRegulation

The Broken Promise of Flexible Liquor Pricing

The Liquor Control Board told the public it would use its expanded pricing powers for consumer benefit. Instead it has used them to benefit only itself.

Memo

Read More: The Broken Promise of Flexible Liquor PricingGovernment Accountability

Worker Freedom in the States

Unprecedented labor issue activity has followed the 2018 Janus v. AFSCME ruling. Read our summary here.

Fact Sheet

Read More: Worker Freedom in the StatesGovernment Accountability

Transparency Can Curb the High Taxpayer Cost of Government Union Contracts

Behind closed doors, Pennsylvania elected officials routinely negotiate billion-dollar contracts with government unions leaders. Three new contracts will cost an additional $1 billion from 2019-23.

Memo

Read More: Transparency Can Curb the High Taxpayer Cost of Government Union ContractsGovernment Accountability

The Janus Impact and Grading of State Public Sector Labor Laws

In the Janus aftermath, pro-union forces make legislative headway counteracting the court decision, while workers push back in the courts. This report details the trends, and grades each state according to…

Report

Read More: The Janus Impact and Grading of State Public Sector Labor LawsState Budget

Slicing Pennsylvania’s Finances, Part 1

Pennsylvania's largest budget items are growing unsustainably fast. The budget can only be brought under control only if these cost drivers are addressed.

Fact Sheet

Read More: Slicing Pennsylvania’s Finances, Part 1Public Union Democracy

Government Unions One Year after Janus v. AFSCME

One year after Janus unions lost significant fee-based revenue, fee-payers largely remain non-union, and existing members—frequently unaware of the ruling or restricted from resigning—often maintain membership…

Memo

Read More: Government Unions One Year after Janus v. AFSCMEEducation

Opportunity Denied Again: Despite Recent Increase, Thousands of Scholarships Still Denied

In 2017-18, the cap on Pennsylvania’s Educational Improvement Tax Credit (EITC) program increased by $10 million. Yet, 49,356 scholarship applications were denied—49% of all applications. To meet demand, lawmakers need…

Memo

Read More: Opportunity Denied Again: Despite Recent Increase, Thousands of Scholarships Still DeniedEducation

EITC & OSTC Escalator: Because Kids Need a Longer Lifeline

Pennsylvania's successful education tax credit programs are oversubscribed, resulting in tens of thousands of families being denied scholarships. It's time to expand these programs. Here are answers to common questions…

Fact Sheet

Read More: EITC & OSTC Escalator: Because Kids Need a Longer Lifeline