Latest Content

Education

What You Need to Know About Pennsylvania’s 2025-26 State Budget

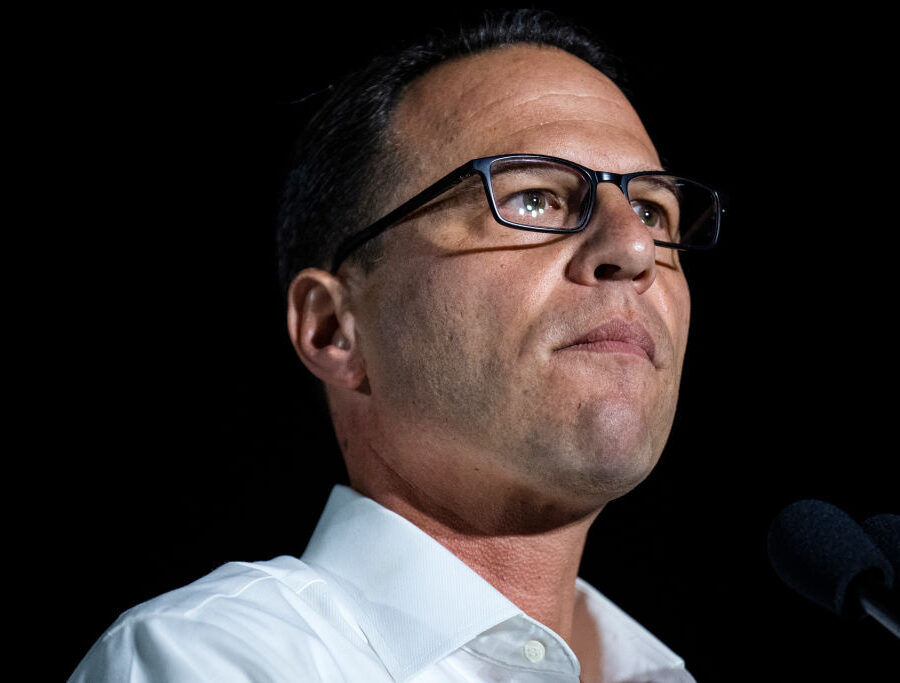

Summary Four months late, Gov. Josh Shapiro and state lawmakers agreed on a state budget deal. The agreement spends $1.4 billion less than Shapiro’s reckless, extreme proposal, and uses excessive…

Read More: What You Need to Know About Pennsylvania’s 2025-26 State Budget

Education

Josh Shapiro: Least Productive Pennsylvania Governor in at Least 50 Years

Read More: Josh Shapiro: Least Productive Pennsylvania Governor in at Least 50 Years

Education

Low-Achieving and Violent Public Schools in Pennsylvania

Read More: Low-Achieving and Violent Public Schools in Pennsylvania

Myths and Facts: Public Cyber Charter Schools

Read More: Myths and Facts: Public Cyber Charter SchoolsState Budget

Making Bad Investments Won’t Restore PA

Governor Wolf’s Restore PA plan utilizes a natural gas severance tax and borrowing to fund infrastructure improvements. There’s a better way to improve our infrastructure.

Memo

Read More: Making Bad Investments Won’t Restore PAEnergy

Climate Change

For decades state government has imposed subsidies, increased regulation and raised energy costs to reduce greenhouse gas emissions. These efforts have largely failed to make an impact. On the other…

Memo

Read More: Climate ChangeEducation

Expand Educational Choice with Tax Credit Scholarships

In 2016-17, the most recent year with scholarship data available, 52,857 K-12 scholarship applications were denied—52 percent of all K-12 applications. Businesses have applied for $180 million in EITC and…

Fact Sheet

Read More: Expand Educational Choice with Tax Credit ScholarshipsCriminal Justice Reform

An Overview of Justice Reinvestment Initiative II

JRI II seeks to address high corrections spending, insufficient support for county probation, and inadequate pretrial and sentencing guidance. The result: fair and effective punishments that equip people for life after…

Fact Sheet

Read More: An Overview of Justice Reinvestment Initiative IIPublic Union Democracy

Restoring Government Workers’ Resignation Rights

Pennsylvania government workers are no longer forced to pay union fees to keep their jobs—but government and union leaders are imposing roadblocks to exercising their rights. Here's how legislators can help.

Memo

Read More: Restoring Government Workers’ Resignation RightsState Budget

The Taxpayer Protection Act: An Updated Legislator’s Guide

Pennsylvanians pay $4,589 per person in state and local taxes, which equals 10.2 percent of residents’ total income. This trend must be reversed by restraining spending growth through long-term reforms…

Fact Sheet

Read More: The Taxpayer Protection Act: An Updated Legislator’s GuidePublic Union Democracy

Government Union 2018 Election Spending

Pennsylvania’s top government union political action committees spent over $12 million during the 2017-18 election cycle, making it the most expensive election cycle in the past ten years.

Fact Sheet

Read More: Government Union 2018 Election SpendingEducation

A Better Tool for Student Opportunity

As the 2019 legislative session begins, lawmakers need to look beyond talking points and get to the root of problems with education. As Pennsylvania illustrates, more money does not guarantee…

Memo

Read More: A Better Tool for Student OpportunityState Budget

Five Ways to Promote Prosperity & Grow the Economy

Revenue collections are $400 million above projections. Next year’s budget should be easy to balance. Instead, lawmakers are looking at a projected $1.7 billion deficit. Why? Pennsylvania continues…

Memo

Read More: Five Ways to Promote Prosperity & Grow the EconomyCriminal Justice Reform

Pennsylvania State Budget Trends

On February 5, Governor Wolf will lay out his proposal for the 2019-20 state budget. Here are some key facts on spending trends, last year’s enacted budget, and challenges going…

Fact Sheet

Read More: Pennsylvania State Budget TrendsGovernment Accountability

How Restoring Workers’ Rights Brings Fairness to All Pennsylvanians

For decades, public sector union leaders have used their unfair political advantages to block public policies that will help our state and citizens flourish. Restoring workers’ rights is critical for a fair…

Memo

Read More: How Restoring Workers’ Rights Brings Fairness to All PennsylvaniansCriminal Justice Reform

The Justice Reinvestment Initiative II

The Justice Reinvestment Initiative recommends fair and effective punishments that equip offenders for life, while controlling costs and improving safety.

Poll

Read More: The Justice Reinvestment Initiative IITaxes & Economy

Pennsylvania’s Path to Tax Relief

Pennsylvania’s high state and local tax burden is hindering job growth, suppressing wages, and enabling wasteful government spending.

Memo

Read More: Pennsylvania’s Path to Tax ReliefEducation

Fact Sheet: School Funding and Student Outcomes

Conversations about improving education often devolve into who will spend more. This enables some policymakers to offer a one-dimensional solution—funding—to a multi-dimensional issue—education. Key questions are ignored when the only…

Fact Sheet

Read More: Fact Sheet: School Funding and Student OutcomesRegulation

Pennsylvania’s Pension Systems

In 2017, Pennsylvania passed landmark pension reform that will kick in come January. But our $70 billion plus liability is still growing and so is the municipal pension crisis.

Memo

Read More: Pennsylvania’s Pension SystemsRegulation

Corporate Welfare’s Record of Failure

In a free market economy, entrepreneurs succeed or fail based on their ability to meet their customers’ needs. Yet all too often, government disrupts this process by conferring tax credits,…

Fact Sheet

Read More: Corporate Welfare’s Record of FailureEducation

Opportunity Denied: To Meet Demand, Tax Credit Scholarship Caps Must Expand

The 2018-19 state budget included a $25 million expansion of Pennsylvania’s Educational Improvement Tax Credit (EITC) program. This will allow up to 15,000 additional students to receive scholarships. While helpful, 52,857…

Memo

Read More: Opportunity Denied: To Meet Demand, Tax Credit Scholarship Caps Must ExpandCriminal Justice Reform

Safer Communities, Smarter Spending

About 95 percent of those confined to state prison will eventually re-enter society. This is why reformers must focus attention on reducing recidivism and balance "tough on crime" practices of the past…

Fact Sheet

Read More: Safer Communities, Smarter SpendingHealth Care

Protecting Home Care Workers from Gov. Wolf’s Invasive Executive Order

Legislative action must correct Gov. Wolf's executive overreach into the daily lives of home care workers and elderly and disabled Pennsylvanians.

Memo

Read More: Protecting Home Care Workers from Gov. Wolf’s Invasive Executive OrderCriminal Justice Reform

Removing Barriers to Work for Ex-Offenders

Pennsylvania has a 3-year recidivism rate of nearly 61 percent. Research shows one of the most critical components of successful re-entry is a job. But for 255…

Memo

Read More: Removing Barriers to Work for Ex-OffendersState Budget

The Tax Cuts and Jobs Act in Pennsylvania

The Tax Cuts and Jobs Act provides tax relief to working people across all income levels. Since its passage, more than 660 businesses have announced raises, bonuses, or enhanced retirement benefits…

Fact Sheet

Read More: The Tax Cuts and Jobs Act in Pennsylvania