Latest Content

Education

What You Need to Know About Pennsylvania’s 2025-26 State Budget

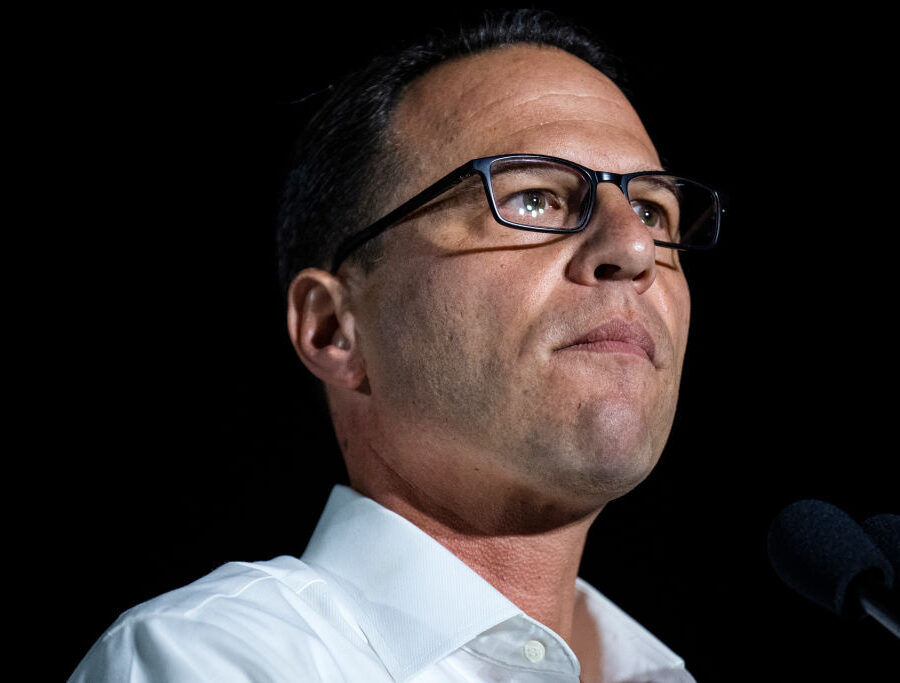

Summary Four months late, Gov. Josh Shapiro and state lawmakers agreed on a state budget deal. The agreement spends $1.4 billion less than Shapiro’s reckless, extreme proposal, and uses excessive…

Read More: What You Need to Know About Pennsylvania’s 2025-26 State Budget

Education

Josh Shapiro: Least Productive Pennsylvania Governor in at Least 50 Years

Read More: Josh Shapiro: Least Productive Pennsylvania Governor in at Least 50 Years

Education

Low-Achieving and Violent Public Schools in Pennsylvania

Read More: Low-Achieving and Violent Public Schools in Pennsylvania

Myths and Facts: Public Cyber Charter Schools

Read More: Myths and Facts: Public Cyber Charter SchoolsState Budget

2022 Pa. Budget Checklist

Limit Spending to Help Pennsylvanians Cope with Inflation Record inflation caused by federal overspending is hitting Pennsylvanians hard. Inflation is up 8.6 percent from last year and…

Fact Sheet

Read More: 2022 Pa. Budget ChecklistEducation

Pa. Education Spending Soars to All-Time High

Key Points Pennsylvania school district spending per student increased to $19,900 in 2020–21.State support of public education is up 40 percent over the last decade, reaching an all-time high of…

Backgrounder

Read More: Pa. Education Spending Soars to All-Time HighEducation

HB 2169: Lifeline Scholarship Program

Overview The Pennsylvania House passed the Lifeline Scholarship Program bill on April 27, 2022. House Bill 2169, if passed by the Senate and signed by the governor, offers an…

Fact Sheet

Read More: HB 2169: Lifeline Scholarship ProgramRegulation

The PLCB’s Boondoggles

PLCB History In 1933, four days before the end of Prohibition, then-Gov. Gifford Pinchot established the Pennsylvania Liquor Control Board (PLCB). Pinchot created the PLCB to fill the regulatory…

Fact Sheet

Read More: The PLCB’s BoondogglesTaxes & Economy

A Brief History of Gov. Tom Wolf’s Tax Hike Proposals

Key Points Wolf proposed or supported 14 tax hike proposals. Twelve were stopped.Wolf’s proposals contained 52 individual tax increases.If Wolf’s first and most expansive tax proposal had come to fruition,…

Fact Sheet

Read More: A Brief History of Gov. Tom Wolf’s Tax Hike ProposalsRegulation

Liquor Privatization Constitutional Amendment

The Constitutional Amendment Process House Bill 2272 proposes an amendment to Article 3, Section F of the Constitution of the Commonwealth of Pennsylvania stating, “The Commonwealth shall not manufacture…

Fact Sheet

Read More: Liquor Privatization Constitutional AmendmentTaxes & Economy

Taxpayer Protection Act: Facts & Myths

Summary The Taxpayer Protection Act (TPA) controls the growth of state spending by tying budget increases to the average rate of inflation and population growth. Moreover, the TPA requires a…

Fact Sheet

Read More: Taxpayer Protection Act: Facts & MythsPublic Union Democracy

Why Pennsylvania Needs Wisconsin-Style Government Union Reform

Key Findings Government unions have enormous political power in Pennsylvania, due to a host of special legal privileges granted in state law.Government union executives use this power to trap government…

Report

Read More: Why Pennsylvania Needs Wisconsin-Style Government Union ReformEducation

Opportunity Unleashed

Key Points In June 2019, Pennsylvania’s General Assembly expanded the Educational Improvement Tax Credit (EITC) and Opportunity Scholarship Tax Credit (OSTC) programs by a combined $30 million. In the 2019-20…

Backgrounder

Read More: Opportunity UnleashedEducation

Education Opportunity Accounts in Practice

Key Points Education Opportunity Accounts (EOAs) are transformative, flexible-use accounts funded by state tax dollars.Program Administration: The Pennsylvania Treasury is the ideal administrator at the state level and may contract…

Backgrounder

Read More: Education Opportunity Accounts in PracticeTaxes & Economy

Pennsylvania’s Population Problems

The Problem New data[1] from the United States Census Bureau shows Pennsylvania’s population problems remain: Pennsylvania’s population decreased by 25,000 from July 2020 to July 2021. Natural population…

Fact Sheet

Read More: Pennsylvania’s Population ProblemsState Budget

Pennsylvania Fiscal Chart Book 2022

Eight charts summarizing how much state government spends and how to strengthen the fiscal health of the commonwealth.

Fact Sheet

Read More: Pennsylvania Fiscal Chart Book 2022State Budget

How Government Overspending Hurts Pennsylvania Families

Key Points Excessive government spending and borrowing is causing record-setting inflation and severe supply chain shortages.Voters want fiscal restraint from their government.High taxes and spending are making Pennsylvania uncompetitive, costing…

Backgrounder

Read More: How Government Overspending Hurts Pennsylvania FamiliesState Budget

Pennsylvania’s Stalled Economy

Summary In 2021, Pennsylvania lagged behind most states in recovering from the COVID-19 shutdown.Challenges like historic inflation and labor shortages will likely persist throughout 2022.This year, lawmakers can reverse these…

Fact Sheet

Read More: Pennsylvania’s Stalled EconomyState Budget

2022 Pa. Budget Checklist

Limit spending growth to the Taxpayer Protection Act (TPA) index The total General Fund spending increase should not exceed the TPA limit of 3.46 percent, or an additional $1.376 billion.

Fact Sheet

Read More: 2022 Pa. Budget ChecklistCriminal Justice Reform

Why Pennsylvania Needs Probation Reform

Pennsylvania has an overburdened probation system that delivers substandard results. The commonwealth’s recidivism rate is 41 percent—one of the highest in the nation.

Backgrounder

Read More: Why Pennsylvania Needs Probation ReformGovernment Accountability

How Pa. Governments Use Tax Dollars to Pay Associations to Lobby

Prohibiting local governments and government agencies from diverting public funds to these associations would increase transparency and prevent taxpayers’ dollars from funding lobbying harmful to taxpayers.

Backgrounder

Read More: How Pa. Governments Use Tax Dollars to Pay Associations to LobbyGovernment Accountability

How Pa. Governments Use Tax Dollars to Pay Contract Lobbyists

Prohibiting local governments and government agencies from diverting public funds to these associations would increase transparency and prevent taxpayers’ dollars from funding lobbying harmful to taxpayers.

Backgrounder

Read More: How Pa. Governments Use Tax Dollars to Pay Contract LobbyistsTaxes & Economy

Top Unemployment Compensation Reforms for Pennsylvania

Overview Pennsylvania should reform its unemployment compensation system to pay down state debt, incentivize hiring, increase labor participation, and minimize fraudulent claims. Reforms should protect unemployment compensation for the individuals…

Fact Sheet

Read More: Top Unemployment Compensation Reforms for Pennsylvania