Backgrounder

Rethinking School District Reserve Funds as Students Return to Class

Pennsylvania must focus on funding students.

Overview

After years of property tax hikes and significant increases in state funding, Pennsylvania school districts ended the 2023–24 school year with more than $13 billion in reserve funds, including $7.4 billion in general fund reserves. Despite claims of underfunded public schools, school districts receive more than $23,000 per student—among the highest in the nation—and have increased reserves in recent years. Annual increases in education spending have not led to improved academic outcomes. Pennsylvania must focus on funding students instead of financially rewarding districts with shrinking enrollments and declining test scores.

Key Points

- General fund reserves held by Pennsylvania school districts: $7.4 billion.

- Total fund reserves held by Pennsylvania school districts: $13.2 billion.

- Reserve funds held by Pennsylvania public cyber charter schools: $500 million.

- Growth in public school district reserves since 2020, amid record funding increases: $2 billion.

- Many school districts, 57 percent, maintain reserve funds in excess of the recommended 20 percent of annual spending. Likewise, 79 percent of cyber charter schools hold reserves above this recommendation.

- Despite increased funding, the latest Pennsylvania State System of Assessment (PSSA) results show more than 71 percent of eighth graders as below proficient in math, and, on the Keystone Exams, scores put more than 58 percent of students as below proficient in algebra.

What Are Reserve Funds?

School district reserves consist of assigned, unassigned, and committed funds. While the intent of assigned funds may be for capital improvements, reserve funds are fungible, and districts can repurpose their use.

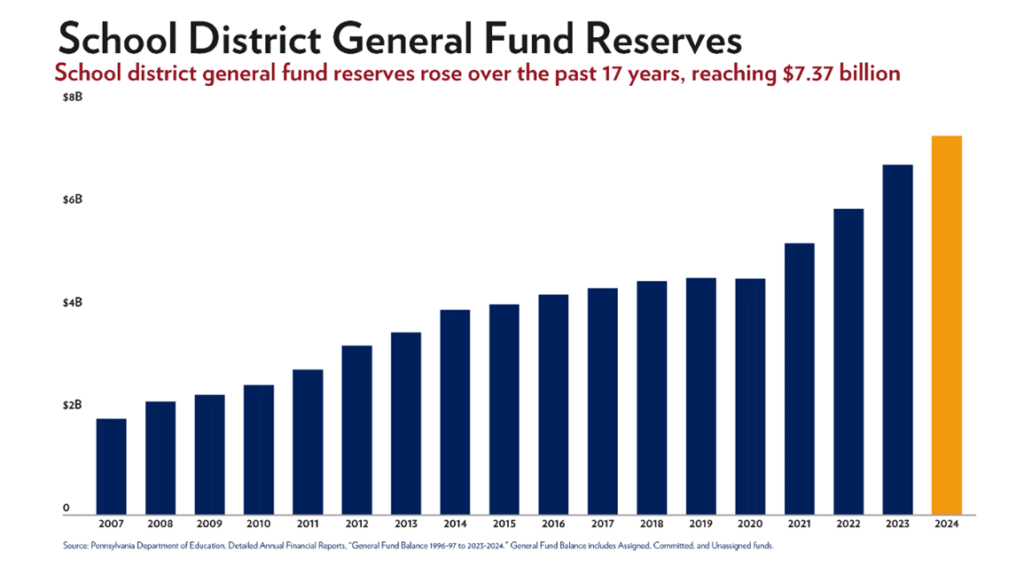

- Pennsylvania school districts hold a record-setting $7.4 billion in general fund reserves, according to the most recent (2023–24) Pennsylvania Department of Education (PDE) annual financial report (AFR) data.

- This represents a $2 billion increase since 2020–21, and, collectively, school district reserve funds have grown in 14 of the past 15 years.1

Total Fund Reserves

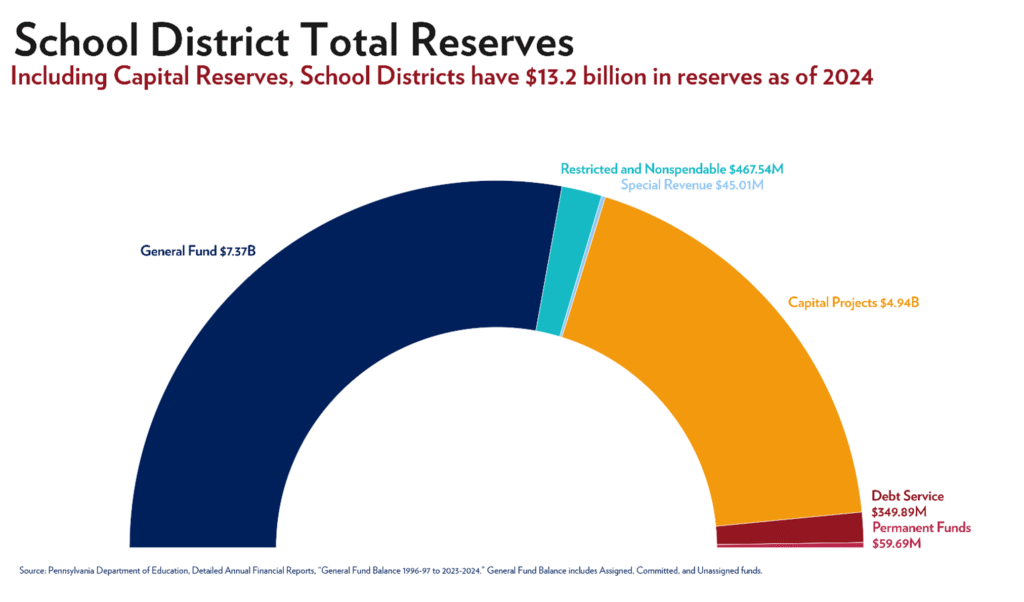

In addition to the assigned, unassigned, and committed funds reported annually by PDE, district non-spendable and restricted reserve funds totaled $468 million as of 2024. Moreover, school districts held $4.6 billion in capital project funds, $45 million in special revenue funds, $349 million in debt service funds, and $59.7 million in permanent funds.

Combined, school districts reported more than $13.2 billion in total reserve funds at the end of the 2023–24 school year. These reserves are equivalent to 34.8 percent of school districts’ total 2023–24 expenditures of $37.97 billion. For comparison, the state’s Budget Stabilization Reserve Fund, known as the Rainy Day Fund, represents only 14.7 percent of the Pennsylvania general fund budget in 2025.

Excessive Reserves Counter Underfunding Claims

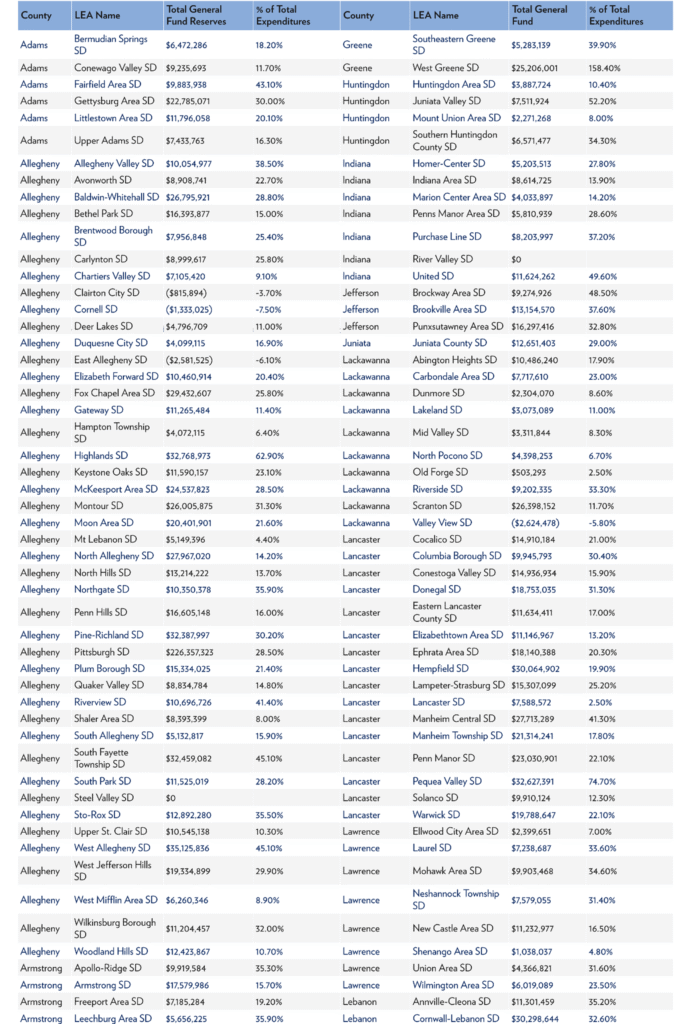

In 2016, the state’s previous auditor general, Eugene DePasquale, recommended that reserve funds be no more than 20 percent of a school district’s total spending.2 Despite this, PDE’s latest AFR data show more than half of the commonwealth’s 500 school districts have general fund reserves in excess of 20 percent of their spending, with an average district general fund reserve balance at 25 percent of expenditures.

- There are 427 districts with general reserve funds above 10 percent of spending.

- Fifty-seven percent, 285 districts, have general reserve funds above 20 percent of spending.

- Sixty-one districts have general fund reserves at 40 percent of spending or greater.3

Reserve levels have grown alongside historic increases in funding.

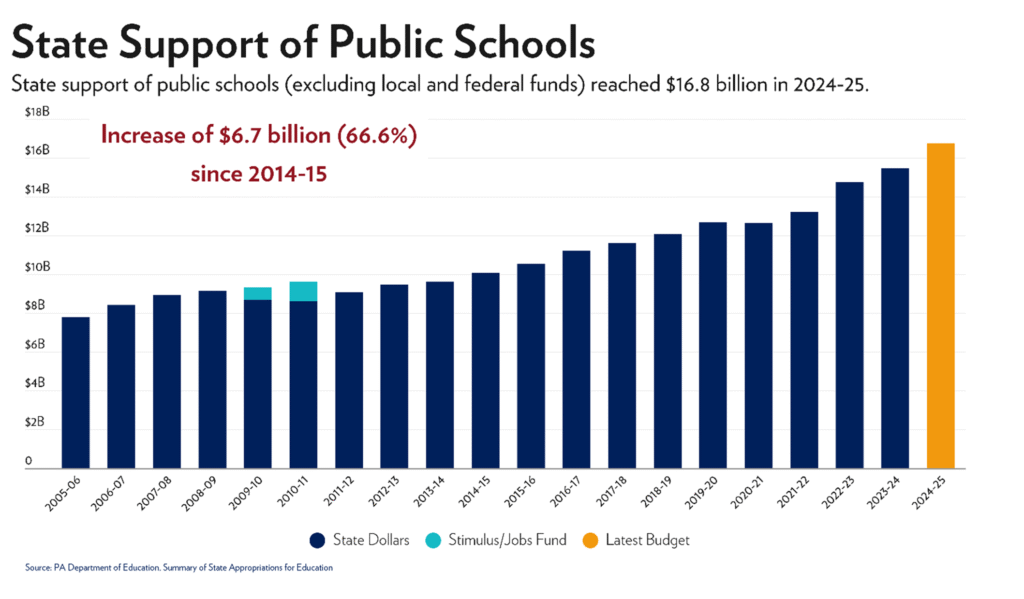

- State funding to school districts increased $6.7 billion over the last decade.

- Federal, state, and local tax dollars for Pennsylvania’s public schools, totaled more than $38.5 billion in the 2023–24 school year, an average of $23,061 per student.4

- The most recent national data (2022) shows that Pennsylvania’s per-student spending ranks seventh-highest in the nation, approximately $4,100 more per student than the national average.5

- Pennsylvania’s 2024–25 budget increased state support of public schools by another $1.3 billion, to $16.8 billion.6

Local Property Taxes Climb Despite Growing Reserves

Limits on local school district property taxes ignore reserve fund balances.

- Local school tax is based on the value of property within the boundaries of a school district.

- School districts calculate property taxes based on a unit of measure called a mill, or millage rate. One mill is equal to one dollar for every $1,000 of a property’s assessed value. A school district with an annual rate of 20 mills results in a tax bill of $2,000 for a property assessed at $100,000.

- The Pennsylvania Taxpayer Relief Act (Act 1) establishes that school districts seeking to raise local taxes above an index limit set by the law must either ask voters for permission via a referendum or apply to the Pennsylvania Department of Education (PDE) for a referendum exception.7

- Notably, PDE assesses referendum exception applications based on school district budgets versus actual cash on hand.

- From the 2023–24 school year to the 2024–25 school year, 72 percent, or 353 of 492 eligible districts, raised taxes.8

- Some were very small increases, yet about one-third hiked millage rates by 5 percent or more.

- While tax hikes with reserve funds are legal, a January 2023 audit by Pennsylvania’s Auditor General Timothy DeFoor called out several districts for “questionable practices that are placing an excess burden on taxpayers across Pennsylvania,” notably, the use of referendum exceptions “as a regular budgeting tool, rather than an extreme measure to meet a fiscal shortfall.”

- All 12 districts audited consistently raised taxes, even while having “an average of more than $360 million collectively in their respective General Funds,” raising questions about the necessity of increasing taxes when reserve funding could be used to cover increased spending.9

Public Cyber Charter School Reserve Funds

Cyber charter schools are public schools, funded by state, local, and federal tax dollars. They cannot turn away students, nor can they raise or collect property taxes.

- Pennsylvania’s 14 public cyber charter schools hold $500 million in reserve funds.

- Eleven (79 percent) hold reserve funds above the 20 percent recommended threshold, compared with the 57 percent of school districts that are above the threshold.10

Pennsylvania’s funding formula is broken. The same funding formula that allows school districts to amass billions in reserve funds pushes cyber schools to guard millions in reserve funds.

- Cyber charter schools have unique needs, resulting in uncertain revenue, which means reserve funds are imperative.

- Cyber schools receive approximately 25 percent less funding per student than district schools. School districts spend nearly $24,000 per year to educate their students but pay only about $14,000 per year in charter tuition for regular education students.

- School districts often refuse to pay cyber charter tuition, forcing cyber schools to rely on reserve funds to keep their doors open.

Record-Setting Funding Not Resulting in Record-Setting Outcomes

Despite record-high state appropriations and bloated reserve funds, enrollment and standardized test scores continue to decline, while school violence is on the rise.

- Public school district enrollment has decreased 9.5 percent since 2014.11

- Student achievement in Pennsylvania remains alarmingly low.

- According to the 2024 National Assessment of Educational Progress (NAEP), or Nation’s Report Card, less than half of Pennsylvania’s public school students are proficient in any category.

- The NAEP results, released in January, show 69 percent of Pennsylvania’s eighth-grade students as not proficient in either math or reading.

- Among fourth graders, only 41 percent reached proficiency in math, with just 31 percent proficient in reading.12

- PSSA’s 2024 scores show more than 71 percent of eighth graders as below proficient in math and approximately 48 percent as below proficient in language arts.

- Pennsylvania’s Keystone Exams administered to high school students reveal more than 58 percent of students score below proficient in algebra, with nearly 37 percent below proficient in literature.13

- According to the 2024 National Assessment of Educational Progress (NAEP), or Nation’s Report Card, less than half of Pennsylvania’s public school students are proficient in any category.

- Pennsylvania public school students face unprecedented levels of violence. More than one-third of all public schools qualify as persistently dangerous, according to PDE incident reports.14

Solutions

Stricter Standards and Greater Oversight. The current levels of reserve funds indicate that many districts have significant financial capacity even as they continue to raise taxes.

- Lawmakers should strengthen oversight by requiring PDE to hold school districts accountable for the substantial resources they already possess before approving further property tax increases.

- To improve transparency and taxpayer protection, the legislature should implement the Auditor General’s recommendations regarding reserve fund usage, including:

- Clarifying how reserve funds are defined.

- Establishing clear benchmarks for appropriate fund balances.

- Implementing stricter limits on reclassifying or shifting funds to bypass statutory caps.

Fund students rather than school district bank accounts. Students deserve more than a system that prioritizes financial stockpiling over academic achievement.

- Pennsylvania must move toward funding students, not systems. Lawmakers have two separate but similar initiatives under consideration to expand school choice for families with children in the state’s lowest-performing schools. The Pennsylvania Award for Student Success Scholarship (PASS) Program, proposed in SB 10, and Lifeline Scholarships, in HB 1489, offer families the power to choose the educational environment that best meets their children’s needs.15

- PASS/Lifeline Scholarships, ranging from $5,000 (grades K–8) and $10,000 (grades 9–12) annually per student, and up to $15,000 annually for special education students would help fulfill the promise of a high-quality education for every child, regardless of zip code or assigned school district.16

- It’s prudent for an entity to have savings in case of emergencies. But when local education agencies (LEAs) hike taxes on residents while hoarding money in reserve accounts, it can become abusive.

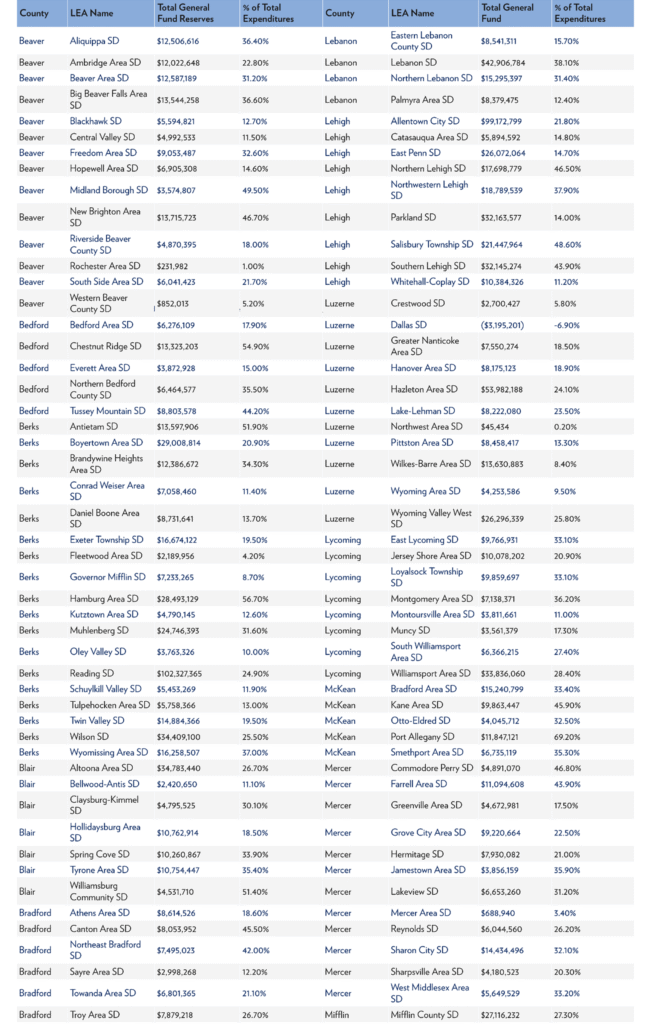

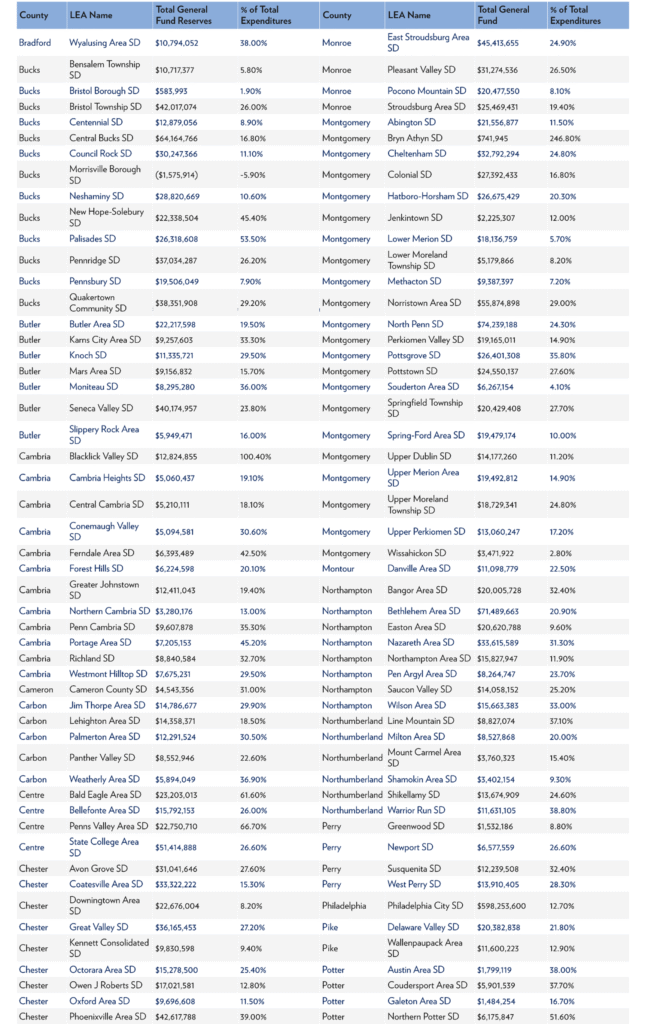

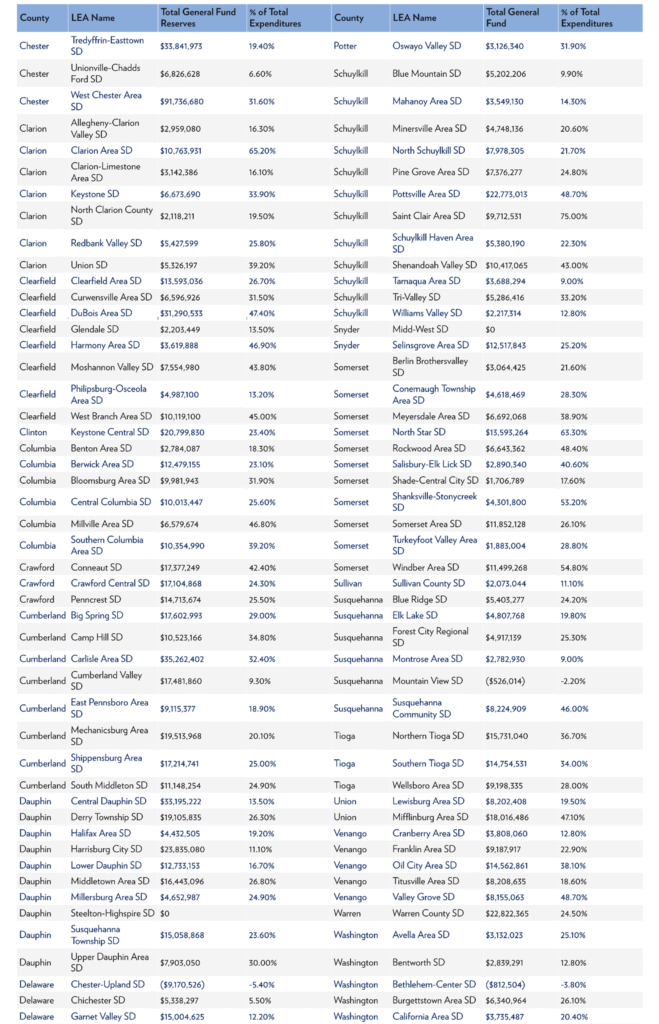

Appendix A: Reserve Funds by District

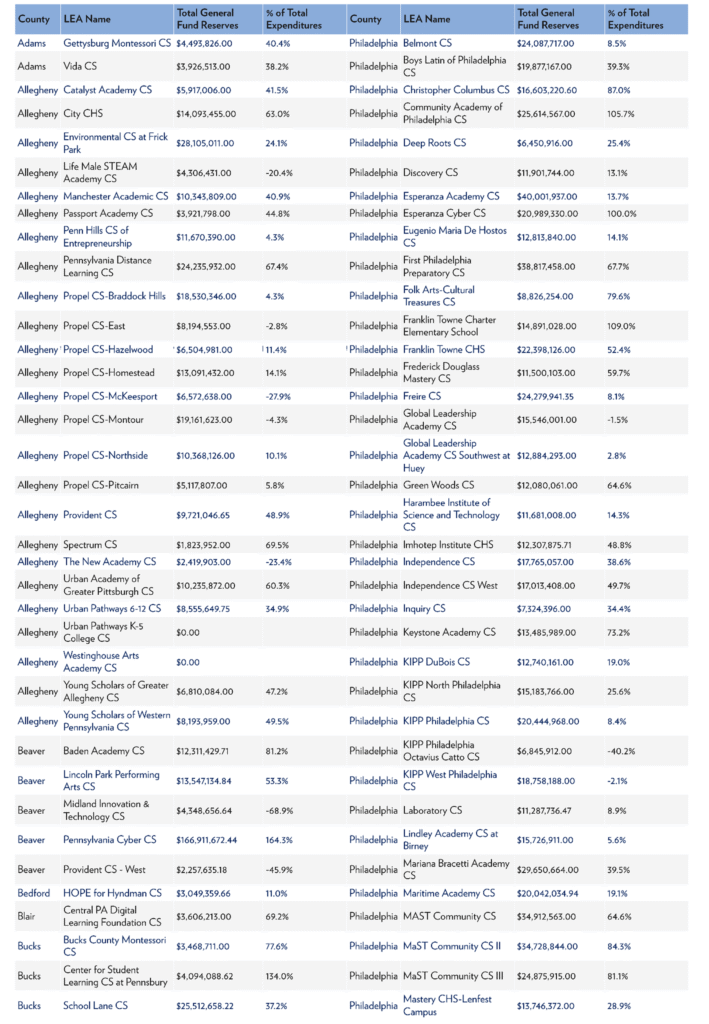

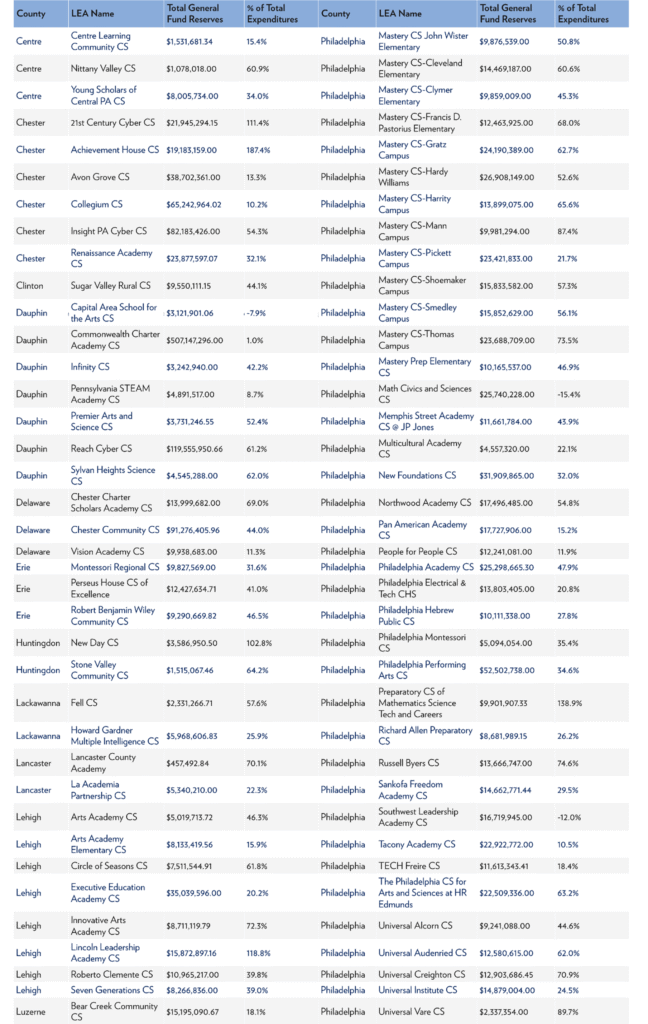

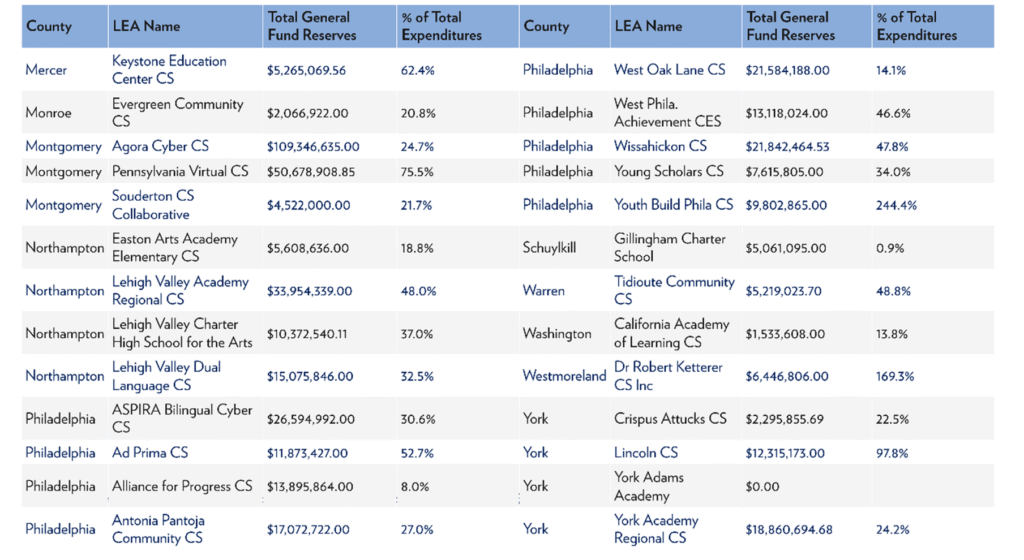

Appendix B: Reserve Funds by Charter School

[1] Pennsylvania Department of Education, Annual Financial Report (AFR) Data Detailed, “General Fund Balance: 2014–15 to 2023–24,” April 2025 [update], https://www.pa.gov/agencies/education/programs-and-services/schools/grants-and-funding/school-finances/financial-data/summary-of-annual-financial-report-data/afr-data-detailed.

[2] Jan Murphy, “School Districts Reserve Funds Continue to Grow, Amassing $4.3 billion in 2014–15,” PennLive Patriot News, June 15, 2016, https://www.pennlive.com/politics/2016/06/school_districts_reserve_funds.html.

[3] Pennsylvania Department of Education, Annual Financial Report (AFR) Data: Detailed, “General Fund Balance 2014–15 to 2023–24”; see also Commonwealth Foundation, “Find Your School District’s Reserves,” May 5, 2025, https://www.commonwealthfoundation.org/research/school-reserves/.

[4] Pennsylvania Department of Education, Annual Financial Report (AFR): Summary-Level, Revenue Data for School Districts, Career and Technology Centers, and Charter Schools (2023–24), April 2025 [update], https://www.pa.gov/agencies/education/programs-and-services/schools/grants-and-funding/school-finances/financial-data/summary-of-annual-financial-report-data/afr-data-summary-level; Commonwealth Foundation, “Pennsylvania School Funding Reaches $23,000 per Student in 2024,” May 15, 2025, https://commonwealthfoundation.org/research/pennsylvania-school-funding-reaches-record-level.

[5] Stephen Q. Cornman et al., “Revenues and Expenditures for Public Elementary and Secondary Education: School Year 2021–22 (Fiscal Year 2022),” (Washington D.C.: National Center for Education Studies, May 7, 2024), 7, https://nces.ed.gov/pubsearch/pubsinfo.asp?pubid=2024301.

[6] Commonwealth Foundation, “2024–25 State Budget Analysis,” July 12, 2024, https://commonwealthfoundation.org/research/2024-25-pa-state-budget-analysis/.

[7] Pennsylvania Department of Education, “Property Tax Relief,” accessed August 20, 2025, https://www.pa.gov/agencies/education/programs-and-services/schools/grants-and-funding/property-tax-relief/referendum-exceptions; see also Act 25 of 2011 (Senate Bill 330), Pennsylvania General Assembly, Regular Session 2011–12, June 30, 2011, https://www.legis.state.pa.us/cfdocs/billinfo/bill_history.cfm?syear=2011&sind=0&body=S&type=B&bn=330.

[8] Pennsylvania Department of Education, General Fund Budget (GFB) Data, accessed August 3, 2025, https://www.pa.gov/agencies/education/programs-and-services/schools/grants-and-funding/school-finances/financial-data/general-fund-budget-gfb-data#sortCriteria=%40copapwpfiscalyear%20descending.

[9] Timothy L. DeFoor, “Performance Audit Report, School Districts – General Fund Balances” (Harrisburg, PA: Pennsylvania Department of the Auditor General, January 2023), 2–5, https://www.paauditor.gov/wp-content/uploads/audits-archive/Media/Default/Reports/speSchoolReservesAuditReport012523.pdf; Pennsylvania Department of the Auditor General, “Auditor General DeFoor Questions Annual Property Tax Increases for 12 School Districts; Calls on Legislature to Close Loopholes,” news release, January 25, 2023, https://www.paauditor.gov/auditor-general-defoor-questions-annual-property-tax-increases-for-12-school-districts-calls-on-legislature-to-close-loopholes/.

[10] Pennsylvania Department of Education, Annual Financial Report (AFR) Data Detailed, “General Fund Balance: 2014–15 to 2023–24.”

[11] Pennsylvania Department of Education, Enrollment: Public School Enrollment Reports, accessed August 20, 2025, https://www.pa.gov/agencies/education/data-and-reporting/enrollment#accordion-cb5f3bee47-item-9b3fcf9ab9.

[12] National Center for Education Statistics, “Nation’s Report Card: Pennsylvania Overview,” January 29, 2025, https://www.nationsreportcard.gov/profiles/stateprofile/overview/PA?chort=1&sub=MAT&sj=PA&sfj=NP&st=MN&year=2022R3&cti=PgTab_OT&fs=Grade; Commonwealth Foundation, “Pennsylvania Public Schools: Nation’s Report Card 2024,” February 25, 2025, https://commonwealthfoundation.org/research/pennsylvania-public-schools-nations-report-card-2024/.

[13] Pennsylvania Department of Education, Assessment Reporting: “2024 PSSA English Language Arts Results,” “2024 PSSA Math Results,” and “2024 Keystone Results,” accessed August 20, 2025, https://www.pa.gov/agencies/education/data-and-reporting/assessment-reporting.

[14] Rachel Langan, “Persistently Dangerous Pennsylvania Public Schools,” Commonwealth Foundation, August 4, 2025, https://commonwealthfoundation.org/research/persistently-dangerous-pennsylvania-public-schools/.

[15] Sen. Judy Ward et al., Senate Bill 10, Pennsylvania General Assembly, Regular Session 2025–26, https://www.palegis.us/legislation/bills/2025/sb10; Rep. Clint Owlett, House Bill 1489, Pennsylvania General Assembly, Regular Session 2025–26, https://www.palegis.us/legislation/bills/2025/hb1489.

[16] Commonwealth Foundation, “PASS/Lifeline Scholarship Program,” May 5, 2025, https://commonwealthfoundation.org/research/lifeline-scholarship-program-pass/.