Fact Sheet

One Big, Beautiful Bill Benefits for Pennsylvanians

Summary

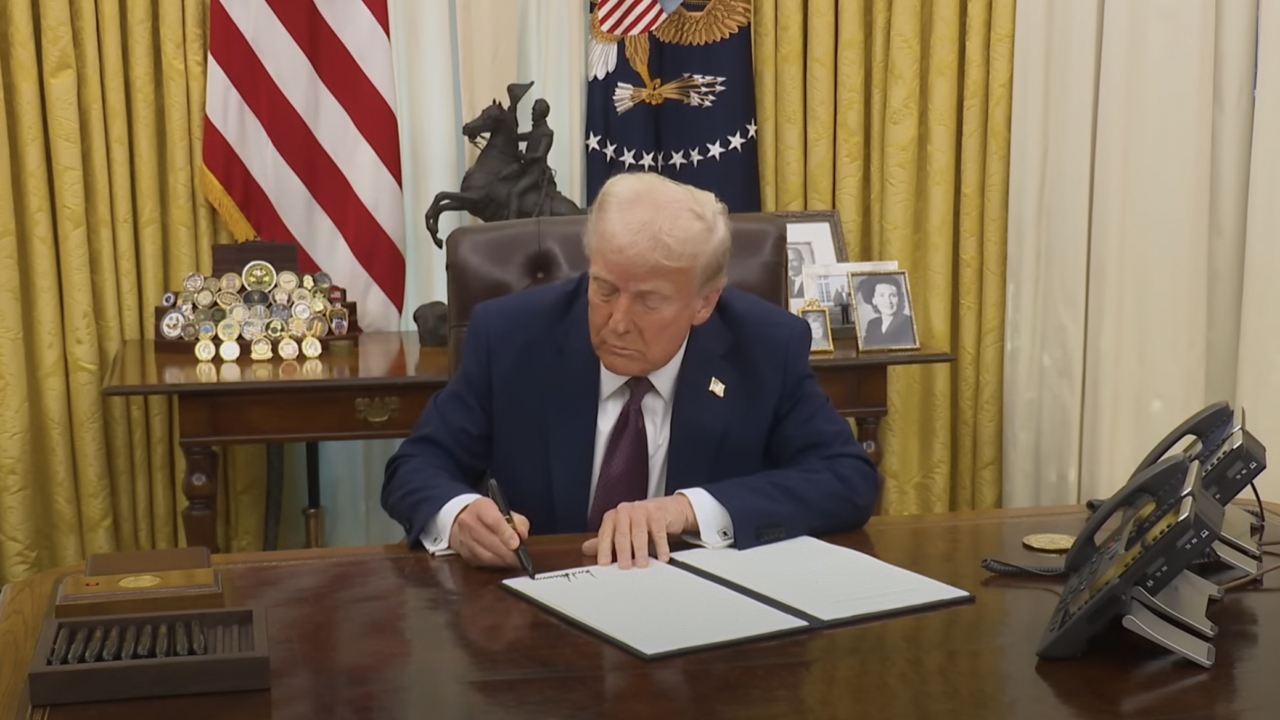

- On July 4, 2025, President Donald Trump signed House Resolution 1, better known as the “One Big, Beautiful Bill Act” (OBBB), into law. Within the 887-page bill are four reforms to prevent tax hikes and lower the cost of living for Pennsylvanians. The OBBB:

- Extends the 2017 federal tax cuts that benefited all income groups, to avoid a $2,500 tax hike on the average Pennsylvania taxpayer.

- Establishes Medicaid work requirements for healthy adults ages 18–64 without children.

- Restores Supplemental Nutrition Assistance Program (SNAP) work requirements for healthy adults ages 18–64 without children under 14.

- Creates the Educational Choice for Children Act (ECCA), a $1,700 individual tax credit for donations to a K–12 scholarship-granting organization.

Protecting Taxpayers from Tax Hikes

- The law prevents an average $2,500 tax hike per Pennsylvania taxpayer by making the 2017 Tax Cuts and Jobs Act tax cuts permanent. Nearly every Pennsylvanian has benefited from these cuts.

- The law provides more tax certainty for households and businesses. For households, a higher standard deduction becomes permanent. The child tax credit also increases to $2,200.

- Businesses can deduct domestic research and experimentation expenses versus amortizing them over five years. Businesses can also expense certain production property if construction is complete by 2031. The Independent Fiscal Office (IFO) estimates that these changes will save Pennsylvania corporations $700 million in corporate net income taxes over the next fiscal year.

- The law also suspends taxes on tips and overtime pay through 2028. However, the cut undermines economic fairness, potentially discouraging pay raises and future broad-based tax cuts.

Medicaid Work Requirements

- Under the OBBB, federal Medicaid spending will increase by more than $200 billion over the next decade (from around $600 billion per year to $800 billion).

- The law imposes biannual eligibility redeterminations and commonsense work requirements for healthy adults ages 18–64 without dependents. These adults must work 80 hours in at least one month out of every three months. The requirement begins in 2027, but states can implement these reforms sooner.

- The work requirement does not apply to seniors, children, parents, or disabled individuals. Healthy adults can only lose Medicaid if they choose not to seek employment, education, or volunteer work.

- Pennsylvania enrolls 832,629 healthy, able-bodied adults in Medicaid (more than double the population of Pittsburgh). The Pennsylvania Department of Human Services (DHS) estimates that 475,000 of these adults are not working.

- The IFO estimates this provision would result in state savings of $220 to $300 million if non-working healthy adults choose not to comply. This is on top of more than $1.9 billion in federal savings, easing pressures for a state tax hike.

- Gov. Josh Shapiro dubiously claims 310,000 of these adults will “lose Medicaid” because they will not be able to find a part-time job, training, or volunteer opportunity by 2027.

- Work requirements have proven effective. In Arkansas, Medicaid work requirements led to increased employment and higher incomes for families.

- The law also prohibits raising state provider taxes and eventually reduces the taxes imposed on hospitals and other health care providers to generate federal matching funds. In response to concerns from hospitals, the law creates a $50 billion Rural Health Transformation Program. Since Medicaid pays significantly less than private insurance for the same medical care, moving individuals from government to private insurance is the best way to sustain rural hospitals.

SNAP Work Requirements

- The law restores SNAP work requirements for healthy adults aged 18–64. Adults without dependents below age 14 must work, train, or volunteer at least 80 hours a month to maintain their benefits. Otherwise, healthy adults receive three months of SNAP every three years.

- Shapiro estimates that 140,000 will lose SNAP, about 65 percent of the individuals impacted. Again, the governor assumes that these healthy adults will not find employment, training, or volunteer work.

- The law also creates more accountability for states by increasing the state share of administrative costs from 50 percent to 75 percent, an additional cost of $125 million. Also, beginning in October 2027, states must pay a share of SNAP benefit costs if their payment error rate is over 6 percent.

- If Pennsylvania continues to have a 10.8 percent error rate, the state would be responsible for an additional $675 million each year. However, if the state can reduce the error rate to under 6 percent, the cost sharing is $0.

- Strengthening SNAP work requirements led to healthy adults doubling their income within a year and tripling it within two years.

Education Choice for Children Act

- The OBBB expands educational choice by establishing a new federal tax credit scholarship program modeled after Pennsylvania’s highly successful Educational Improvement Tax Credit Program.

- Starting in 2027, donors in any state will be able to donate a maximum of $1,700 annually to one of more than 250 scholarship organizations in Pennsylvania, assuming Governor Shapiro opts in.

- The scholarships are designated for working-class families with household incomes up to 300 percent of the median gross income level who choose a private school, microschool, or homeschooling.

- Because ECCA is similar to Pennsylvania’s tax credit scholarship programs, Pennsylvania can quickly adapt to ECCA guidelines and unlock new funding for families.

Conclusion

- Recent polling shows overwhelming bipartisan support for these reforms.

- In addition, the law phases out subsidies for less-reliable wind and solar energy, potentially saving Pennsylvanians from even higher utility bills.

- From scholarships to preserving critical safety nets to avoiding federal tax hikes, the OBBB benefits Pennsylvanians.