Latest Content

Education

What You Need to Know About Pennsylvania’s 2025-26 State Budget

Summary Four months late, Gov. Josh Shapiro and state lawmakers agreed on a state budget deal. The agreement spends $1.4 billion less than Shapiro’s reckless, extreme proposal, and uses excessive…

Read More: What You Need to Know About Pennsylvania’s 2025-26 State Budget

Education

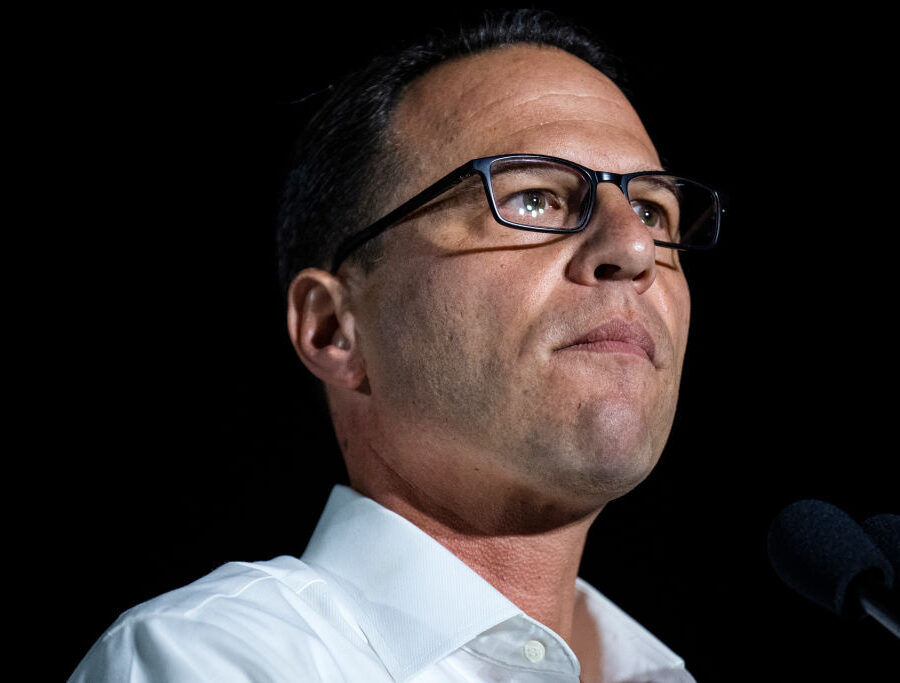

Josh Shapiro: Least Productive Pennsylvania Governor in at Least 50 Years

Read More: Josh Shapiro: Least Productive Pennsylvania Governor in at Least 50 Years

Education

Low-Achieving and Violent Public Schools in Pennsylvania

Read More: Low-Achieving and Violent Public Schools in Pennsylvania

Myths and Facts: Public Cyber Charter Schools

Read More: Myths and Facts: Public Cyber Charter SchoolsState Budget

Marijuana Money Can’t Fix the Budget

The dollars involved are small and legalization would create new expenses.

Memo

Read More: Marijuana Money Can’t Fix the BudgetHealth Care

Preserving Medicaid: How to Stop Shortchanging Patients and Bankrupting Taxpayers

Pennsylvania is a Medicaid leader in all the wrong ways. Enrollment has skyrocketed beyond population growth, and the state ranks fourth in the share of the state budget consumed by Medicaid.

Report

Read More: Preserving Medicaid: How to Stop Shortchanging Patients and Bankrupting TaxpayersEducation

Unleashing Educational Opportunity

Applying cautious estimates, this study finds that the two private school choice programs in Pennsylvania are expected to provide billions in long-run economic benefits from higher lifetime earnings, fewer high…

Report

Read More: Unleashing Educational OpportunityEducation

Pa. has $1 billion in CARES aid left. Where should it go?

As the pandemic slows, it’s time to step back and reevaluate Pennsylvania’s remaining needs for coronavirus relief. How can our state government ensure that the citizens and businesses who most…

Fact Sheet

Read More: Pa. has $1 billion in CARES aid left. Where should it go?Criminal Justice Reform

Probation Reform Proposals Prioritize Public Safety and Cost Savings

The next step toward smart justice? Probation reform to reduce caseloads, prevent reoffending, produce savings, and break down unnecessary roadblocks to success.

Memo

Read More: Probation Reform Proposals Prioritize Public Safety and Cost SavingsEducation

The Race to Rebuild: How Pa. Can Bounce Back After COVID-19

Pennsylvanians are facing some of the biggest challenges of their lifetimes. It is time for lawmakers to launch a race to rebuild Pennsylvania using the following policy solutions.

Report

Read More: The Race to Rebuild: How Pa. Can Bounce Back After COVID-19Regulation

Competition, Not Corporate Welfare: 3 Ways to Help All Businesses Flourish

To effectively promote economic growth and job creation, policymakers need to stop investing tax dollars in failed programs and start enacting policies that benefit a wide range of job creators.

Memo

Read More: Competition, Not Corporate Welfare: 3 Ways to Help All Businesses FlourishEnergy

Pa. Can Energize Its Energy Sector by Cutting Red Tape—Not with Industry Subsidies

This week the state legislature passed House Bill 732. The bill—designed to exempt volunteer service providers from a 1 percent realty transfer tax— now offers tax credits to the…

Memo

Read More: Pa. Can Energize Its Energy Sector by Cutting Red Tape—Not with Industry SubsidiesGovernment Accountability

5 Ways Lawmakers can Avert a COVID-19 Lawsuit Frenzy

The economy is reopening, but the threat of lawsuits from COIVD-19 exposure is just beginning.

Fact Sheet

Read More: 5 Ways Lawmakers can Avert a COVID-19 Lawsuit FrenzyPublic Union Democracy

Public-Sector Unions Two Years After Janus v. AFSCME

Two years after Janus freed workers from forced union fees, public sector employees are still fighting for greater protection.

Fact Sheet

Read More: Public-Sector Unions Two Years After Janus v. AFSCMECriminal Justice Reform

Lawmakers Move Two Key Criminal Justice Reforms

Pennsylvania General lawmakers moved two key criminal justice reform bills aimed at improving Pennsylvania’s onerous probation system and limiting the excessive burdens of a criminal record.

Memo

Read More: Lawmakers Move Two Key Criminal Justice ReformsState Budget

Strange Budget for Strange Times: 2020-2021 State Budget Overview

State assembly funds the government through November with a budget chock full of federal aid. …

Memo

Read More: Strange Budget for Strange Times: 2020-2021 State Budget OverviewRegulation

PLCB is Bad for Business

The PLCB harms Pa. businesses in an industry that has been decimated by COVID-19.

Fact Sheet

Read More: PLCB is Bad for BusinessRegulation

PLCB’s Mishandling of COVID-19

The coronavirus pandemic has shown the state liquor control board's inability to provide Pennsylvanian's the service the deserve.

Fact Sheet

Read More: PLCB’s Mishandling of COVID-19Regulation

Economic Aspects of Liquor Privatization

The Pennsylvania Liquor Control Board (PLCB) is a highly unprofitable monopoly with extraordinary powers that have recently been used to increase prices and harm businesses.

Fact Sheet

Read More: Economic Aspects of Liquor PrivatizationGovernment Accountability

Solutions to Preventing Tax Increases in 2021

Lawmakers can respect the Pennsylvania constitution’s balanced budget amendment and act to prevent tax increases that will drive more families and businesses out of the state, further shrinking the revenue…

Memo

Read More: Solutions to Preventing Tax Increases in 2021Government Accountability

Slicing Pennsylvania’s Finances, Part 3

The state government uses special entities to borrow in excess of the constitutional debt limit and make loans and guarantees that would otherwise be illegal.

Report

Read More: Slicing Pennsylvania’s Finances, Part 3Health Care

Best Ways to Spend Federal Virus Relief Money

Relief measures should help people and not the government. They should be temporary, clear, and direct.

Fact Sheet

Read More: Best Ways to Spend Federal Virus Relief MoneyHealth Care

Pennsylvania’s Healthcare Should Always be Crisis Ready

COVID-19 has done its part to highlight the weaknesses of Pennsylvania’s healthcare sector. Primarily, what has been revealed is a lack of flexibility, and regulations that make it difficult to…

Report

Read More: Pennsylvania’s Healthcare Should Always be Crisis ReadyHealth Care

Breaking Down Barriers Following COVID-19

COVID-19 has kept many Pennsylvanians from frequenting the neighborhood coffee shops, nail salons, or retailers they once took for granted. But that’s not the real tragedy—even after stay at home…

Fact Sheet

Read More: Breaking Down Barriers Following COVID-19Health Care

Top 10 Corona Virus FAQ’s for Pennsylvanians

Since the COVID-19 pandemic spread to Pennsylvania, we’ve been deluged with questions about what state government is doing. Below are the top 10 questions we’ve been asked with our quick…

Fact Sheet

Read More: Top 10 Corona Virus FAQ’s for Pennsylvanians