Latest Content

Education

What You Need to Know About Pennsylvania’s 2025-26 State Budget

Summary Four months late, Gov. Josh Shapiro and state lawmakers agreed on a state budget deal. The agreement spends $1.4 billion less than Shapiro’s reckless, extreme proposal, and uses excessive…

Read More: What You Need to Know About Pennsylvania’s 2025-26 State Budget

Education

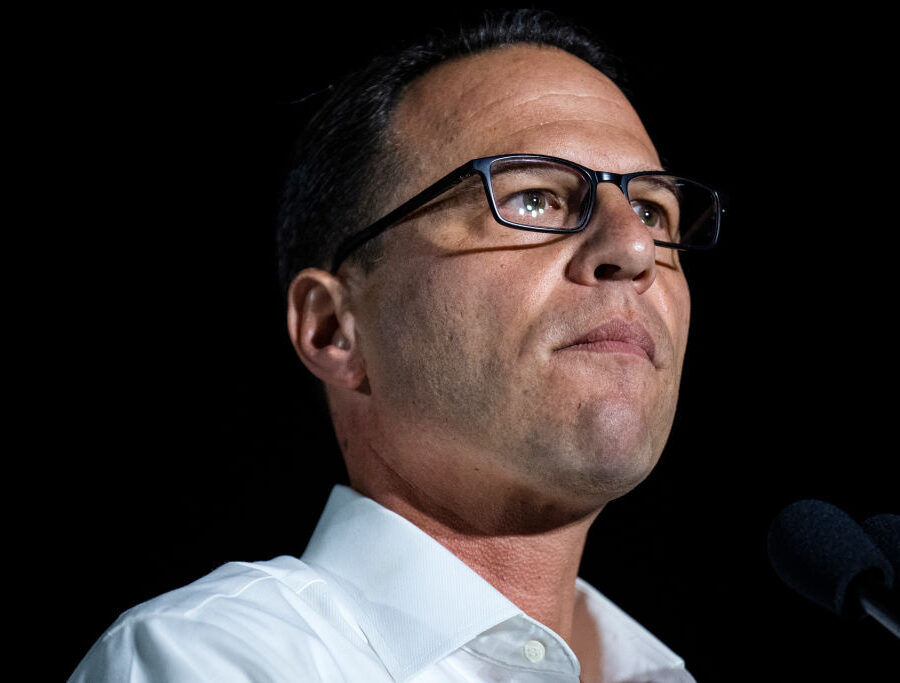

Josh Shapiro: Least Productive Pennsylvania Governor in at Least 50 Years

Read More: Josh Shapiro: Least Productive Pennsylvania Governor in at Least 50 Years

Education

Low-Achieving and Violent Public Schools in Pennsylvania

Read More: Low-Achieving and Violent Public Schools in Pennsylvania

Myths and Facts: Public Cyber Charter Schools

Read More: Myths and Facts: Public Cyber Charter SchoolsTaxes & Economy

Act 44 & Transportation Funding

In July 2007, the Pennsylvania General Assembly passed and Governor Ed Rendell signed Act 44. This legislation authorized the Pennsylvania Turnpike Commission (PTC) to increase tolls on the Turnpike;…

Fact Sheet

Read More: Act 44 & Transportation FundingEducation

A Pennsylvania School Report Card

Politicians and school officials frequently point to student performance on state tests as a primary measure of the quality of public education. According to the Pennsylvania Department of Education, the…

Fact Sheet

Read More: A Pennsylvania School Report Card

Leasing the Turnpike: Frequently Asked Questions and Answers

Tthe Commonwealth Foundation and the Los Angeles-based Reason Foundation released a policy brief entitled Leasing the Turnpike: Frequently Asked Questions and Answers to help enhance and enlighten the current transportation…

Fact Sheet

Read More: Leasing the Turnpike: Frequently Asked Questions and AnswersHealth Care

Medicaid Reform: Mending the Holes in Pennsylvanias Health Care Safety Net

Politicians and school officials frequently point to student performance on state tests as a primary measure of the quality of public education. According to the Pennsylvania Department of Education, the…

Report

Read More: Medicaid Reform: Mending the Holes in Pennsylvanias Health Care Safety NetEducation

A Primer on Pennsylvania Cyber Schools

Executive Summary An increasing number of parents are choosing Pennsylvania’s cyber charter schools for their children every year. Between 2001 and 2006, enrollment grew from 1,848 to almost 16,000 students.

Fact Sheet

Read More: A Primer on Pennsylvania Cyber SchoolsEducation

Cyber Schools: Frequently Asked Questions

Hearings are being held across the state on legislation for limits on spending by public cyber schools The proposed legislation is a response to criticism that cyber schools are not…

Fact Sheet

Read More: Cyber Schools: Frequently Asked QuestionsRegulation

Government on a Diet: Spending Tips 2008

State government consumption and spending of taxpayer money has grown rapidly over the years. Since 1970, Pennsylvania’s operating budget increased from $4.2 billion to $59 billion in FY 2007-2008, an…

Report

Read More: Government on a Diet: Spending Tips 2008Taxes & Economy

Pennsylvania Turnpike Commission vs. PennDOT

Act 44 of 2007 dramatically expanded the scope and power of the Pennsylvania Turnpike Commission (PTC) to increase tolls on the 537-mile Turnpike; enter into a lease agreement with…

Fact Sheet

Read More: Pennsylvania Turnpike Commission vs. PennDOTState Budget

The Truth About Spending Limits

Pennsylvanians want limits placed on the annual increases in state government spending. Despite the strong support of taxpayers, many special interest groups that profit from higher taxes and more government…

Fact Sheet

Read More: The Truth About Spending LimitsHealth Care

“Cover All Pennsylvanians” Covers Very Few

Governor Rendell’s proposed “Cover All Pennsylvanians” claims to provide health insurance for an Administration-estimated 800,000 currently uninsured Pennsylvania adults at a cost of $1 billion dollars in just four years.

Fact Sheet

Read More: “Cover All Pennsylvanians” Covers Very FewEnergy

Energy Policy

Governor Ed Rendell has proposed issuing $850 million in new debt to subsidize select “alternative energy” companies and energy conservation efforts, along with a mandate that every gallon of…

Fact Sheet

Read More: Energy PolicyGovernment Accountability

Campaign Finance Limits & Public Funding

Pennsylvania lawmakers are considering legislation that would limit campaign contributions and would allow for taxpayer financing of gubernatorial campaigns. This legislation is based on the “Clean Election” model passed by…

Fact Sheet

Read More: Campaign Finance Limits & Public FundingEducation

The Dollars and Sense of School Choice

Introduction Every year, most Pennsylvania homeowners receive larger property tax bills due to increases in public school spending. In the nine school years from 1997 to 2006, school property taxes…

Fact Sheet

Read More: The Dollars and Sense of School ChoiceEducation

Edifice Complex: Where Has All the Money Gone?

From the 1986-87 to 2005-06 school years, taxpayer spending on Pennsylvania’s government-run K-12 schools increased from $6.6 billion to almost $22 billion—a 72% increase after adjusting for inflation. Between…

Report

Read More: Edifice Complex: Where Has All the Money Gone?Regulation

Smoking Bans

The effort to ban smoking in restaurants, bars, and private businesses is a product of bad science and worse economics.

Fact Sheet

Read More: Smoking BansTaxes & Economy

Spending Diet Step #3: Stop Over-Taxing

Commonwealth Foundation calls on lawmakers to return the state’s $650 million surplus to taxpayers HARRISBURG, PA — Today, the Commonwealth Foundation called upon the General Assembly to return the state’s…

Fact Sheet

Read More: Spending Diet Step #3: Stop Over-TaxingTaxes & Economy

Mass Transit Reform: Lessons for Pennsylvania

Executive Summary Pennsylvania’s two major public transit agencies, the Philadelphia-area Southeastern Pennsylvania Transportation Authority (SEPTA) and the Pittsburgh-based Port Authority Transit (PAT), have been in financial crisis for years, with…

Fact Sheet

Read More: Mass Transit Reform: Lessons for PennsylvaniaEducation

Taxpayer-Funded Preschool: Count the Costs

Governor Ed Rendell’s budget proposal for the 2007-08 fiscal year includes $75 million for “Pre-K Counts”—a taxpayer-funded program which would provide grants to school districts, Head Start programs, and government-approved…

Fact Sheet

Read More: Taxpayer-Funded Preschool: Count the CostsEducation

Taxpayer-Funded, Universal Preschool in Pennsylvania: Benefits Questioned

The push toward taxpayer-funded preschool for every child in Pennsylvania continues with Governor Rendell’s budget proposal for the 2007-08 fiscal year. The Governor wants $75 million for “Pre-K Counts,” which…

Fact Sheet

Read More: Taxpayer-Funded, Universal Preschool in Pennsylvania: Benefits QuestionedTaxes & Economy

Act 1 Property-to-Income Tax Shift

On May 15, 2007, voters across the Commonwealth will be asked to vote on a property-to-income tax shift to pay for public education expenditures. The Property Tax Relief Act of…

Fact Sheet

Read More: Act 1 Property-to-Income Tax ShiftTaxes & Economy

The Emerging Paradigm: Financing and Managing Pennsylvanias Transportation Infrastructure and Mass Transit

In November 2006, Governor Ed Rendell’s Pennsylvania Transportation Funding and Reform Commission identified a $1.7 billion annual shortfall in funding for the Commonwealth’s transportation infrastructure and mass transit services. The…

Report

Read More: The Emerging Paradigm: Financing and Managing Pennsylvanias Transportation Infrastructure and Mass Transit