Latest Content

Education

What You Need to Know About Pennsylvania’s 2025-26 State Budget

Summary Four months late, Gov. Josh Shapiro and state lawmakers agreed on a state budget deal. The agreement spends $1.4 billion less than Shapiro’s reckless, extreme proposal, and uses excessive…

Read More: What You Need to Know About Pennsylvania’s 2025-26 State Budget

Education

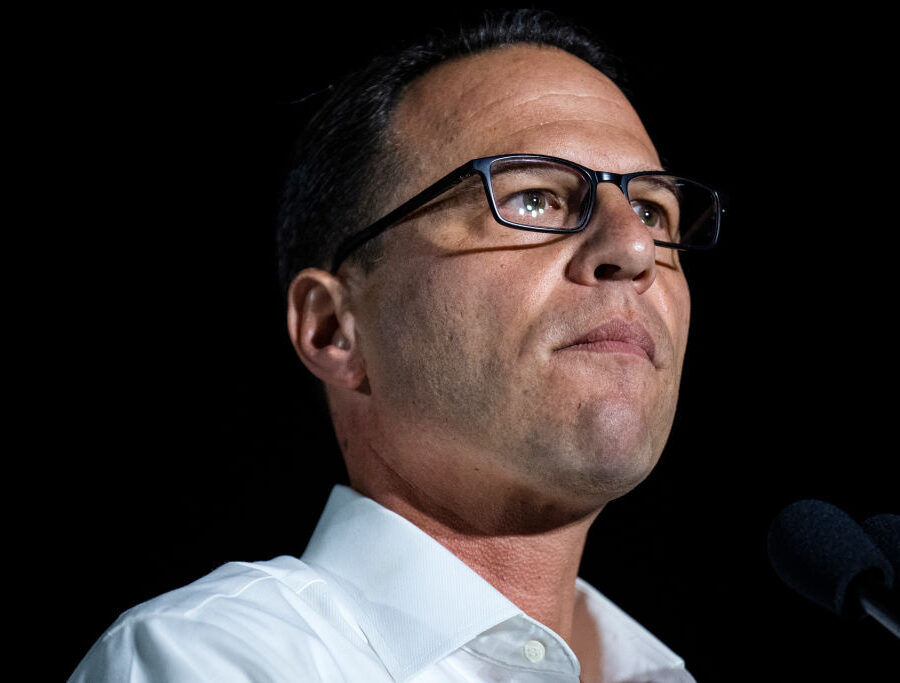

Josh Shapiro: Least Productive Pennsylvania Governor in at Least 50 Years

Read More: Josh Shapiro: Least Productive Pennsylvania Governor in at Least 50 Years

Education

Low-Achieving and Violent Public Schools in Pennsylvania

Read More: Low-Achieving and Violent Public Schools in Pennsylvania

Myths and Facts: Public Cyber Charter Schools

Read More: Myths and Facts: Public Cyber Charter SchoolsState Budget

Total Cost of Pennsylvania Government: 2005 and Beyond

The total cost of state and local government in Pennsylvania is projected to exceed $102 billion in FY 2004-05, and will likely reach more than $115 billion by the 2008-09…

Fact Sheet

Read More: Total Cost of Pennsylvania Government: 2005 and Beyond

Rail Transit: “Corridor One”

Although everyone agrees that traffic congestion and air pollution are neither good nor desirable for Central Pennsylvania, regional rail transit—otherwise known as “Corridor One”—is not the solution to these problems.

Fact Sheet

Read More: Rail Transit: “Corridor One”Regulation

Telecommunications

The debate over the future of high-tech communications development in Pennsylvania parallels the debate over statewide economic development policy in general: Should state government raise taxes on families and businesses…

Fact Sheet

Read More: TelecommunicationsEducation

Referendum: School Taxes

Pennsylvania homeowners lack the right to vote on school property tax increases, while citizens in 44 other states enjoy some form of taxpayer protection. As Pennsylvania legislators debate whether or…

Fact Sheet

Read More: Referendum: School TaxesTaxes & Economy

The Rendell Strategic Sourcing Initiative: An Analysis

Executive Summary …

Fact Sheet

Read More: The Rendell Strategic Sourcing Initiative: An AnalysisTaxes & Economy

Great Rail Disasters: The Impact of Rail Transit on Urban Livability

Abstract This paper grades rail transit in twenty-three urban areas on thirteen different criteria:…

Report

Read More: Great Rail Disasters: The Impact of Rail Transit on Urban LivabilityEducation

Racial Bias in Pennsylvania Special Education

Executive Summary…

Fact Sheet

Read More: Racial Bias in Pennsylvania Special EducationGovernment Accountability

Reinventing Education in Pennsylvania: Fulfilling the Promise of Public Schooling

For more than 250 years, Pennsylvanians have striven to bring academic excellence within reach of their children. In the mid 1700s, when Harvard, Yale, Princeton, and William & Mary colleges…

Report

Read More: Reinventing Education in Pennsylvania: Fulfilling the Promise of Public SchoolingEducation

Pennsylvanias Education Funding Gap

Executive Summary…

Fact Sheet

Read More: Pennsylvanias Education Funding GapTaxes & Economy

The Estimated Impact of Gov. Rendells 34 Percent Personal Income Tax Increase Proposal

Executive Summary A major funding stream for Gov. Ed Rendell’s “Plan for a New Pennsylvania” would come from a 34 percent increase in the Commonwealth’s personal income tax (PIT), from…

Fact Sheet

Read More: The Estimated Impact of Gov. Rendells 34 Percent Personal Income Tax Increase ProposalTaxes & Economy

The Case for a Pennsylvania Tax and Expenditure Limitation

Executive Summary In recent years, states across the United States with both limits on how much their governments can tax and/or spend and “super-majority” provisions that make it more difficult…

Fact Sheet

Read More: The Case for a Pennsylvania Tax and Expenditure LimitationRegulation

Pennsylvanias $2 Billion Corporate Giveaway

Executive Summary Current proposals under consideration in the Pennsylvania General Assembly would grant limited gambling licenses to horse racetracks across the Commonwealth in an attempt to bolster the struggling industry.

Fact Sheet

Read More: Pennsylvanias $2 Billion Corporate GiveawayRegulation

Betting On Gambling: Potential Costs and Consequences for Pennsylvania

Executive Summary …

Fact Sheet

Read More: Betting On Gambling: Potential Costs and Consequences for PennsylvaniaEducation

Getting More, Paying Less: Children, Taxpayers, and Public Schools Benefit from the Educational Improvement Tax Credit

Executive Summary The public school system is one of the most expansive and expensive government monopolies in America. Yet both real-world experience and economic research suggest that this monopoly of…

Fact Sheet

Read More: Getting More, Paying Less: Children, Taxpayers, and Public Schools Benefit from the Educational Improvement Tax CreditTaxes & Economy

Economic Development

Across the United States, state and local governments are locked in a constant competition to attract and retain businesses. Public subsidies, in the form of grants, loans, tax incentives, and…

Fact Sheet

Read More: Economic DevelopmentRegulation

The Economic Impacts of Introducing Slot Machines at Racetracks in Pennsylvania: A Review of the Penn State Harrisburg Study

Purpose …

Fact Sheet

Read More: The Economic Impacts of Introducing Slot Machines at Racetracks in Pennsylvania: A Review of the Penn State Harrisburg StudyState Budget

Rightsizing State Government: Solutions to Pennsylvanias Fiscal and Economic Challenges

Executive Summary “[W]e must find a way to make government live within its means. That is my first priority as governor. We must act now, and we cannot fail. We…

Fact Sheet

Read More: Rightsizing State Government: Solutions to Pennsylvanias Fiscal and Economic ChallengesPublic Union Democracy

The Impact of Compulsory Unionism on Economic Development

Executive Summary With increasing global competition taking a toll on U.S. manufacturing jobs, and state governments and municipalities struggling to achieve greater operating efficiencies in the face of declining revenues…

Report

Read More: The Impact of Compulsory Unionism on Economic DevelopmentEducation

Property Tax & School Funding Reform: The Michigan Experience and Principles for Pennsylvania

Executive Summary After decades of relative inaction, Pennsylvania policymakers may finally tackle the issue of property-tax and school-funding reform. While states such as Michigan have already substantively addressed the problem…

Fact Sheet

Read More: Property Tax & School Funding Reform: The Michigan Experience and Principles for PennsylvaniaEducation

The Pennsylvania State Education Association: Compelling Teachers, Lobbying Politicians, and Increasing Taxes

Executive Summary Originally founded as the Pennsylvania State Teachers Association in 1852, the Pennsylvania State Education Association (PSEA) has transformed itself from a professional development organization for educators into one…

Fact Sheet

Read More: The Pennsylvania State Education Association: Compelling Teachers, Lobbying Politicians, and Increasing TaxesTaxes & Economy

R. A. D. is Bad for Pennsylvania

Executive Summary A quiet campaign is currently underway to increase taxes on consumers in four central Pennsylvania counties. By granting elected officials in those counties the power to create a…

Fact Sheet

Read More: R. A. D. is Bad for Pennsylvania