Latest Content

Education

What You Need to Know About Pennsylvania’s 2025-26 State Budget

Summary Four months late, Gov. Josh Shapiro and state lawmakers agreed on a state budget deal. The agreement spends $1.4 billion less than Shapiro’s reckless, extreme proposal, and uses excessive…

Read More: What You Need to Know About Pennsylvania’s 2025-26 State Budget

Education

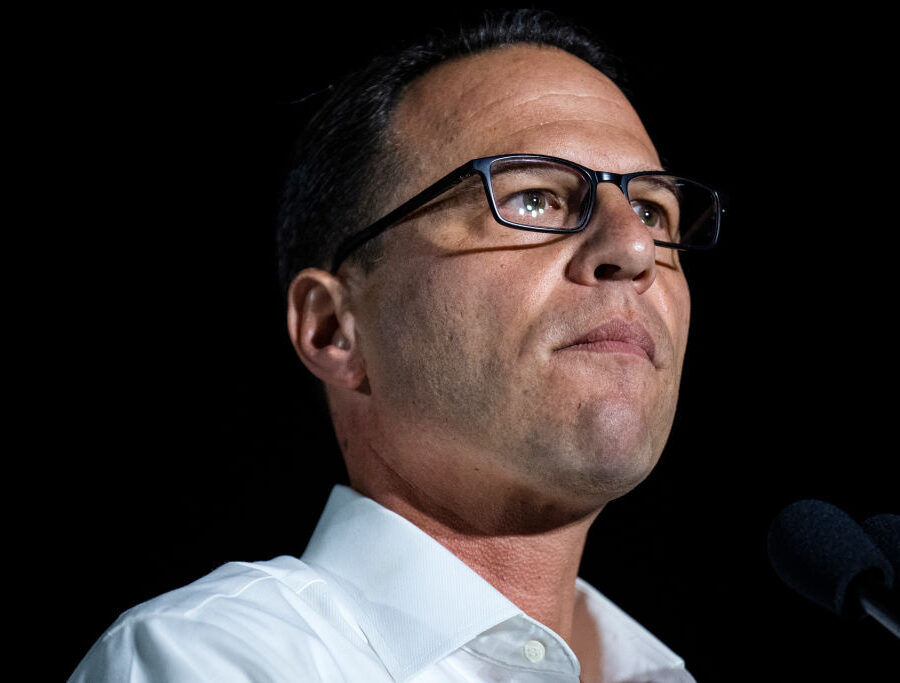

Josh Shapiro: Least Productive Pennsylvania Governor in at Least 50 Years

Read More: Josh Shapiro: Least Productive Pennsylvania Governor in at Least 50 Years

Education

Low-Achieving and Violent Public Schools in Pennsylvania

Read More: Low-Achieving and Violent Public Schools in Pennsylvania

Myths and Facts: Public Cyber Charter Schools

Read More: Myths and Facts: Public Cyber Charter SchoolsState Budget

Takeaways from the Unfinished 2023–24 State Budget

Summary The state budget remains unfinished. While Gov. Josh Shapiro signed off on the general appropriation bill (House Bill 611), authorizing more than $40 billion in state general fund spending,…

Fact Sheet

Read More: Takeaways from the Unfinished 2023–24 State BudgetRegulation

Shapiro’s First Six Months Least Productive Legislatively in 50 Years

Overview An analysis by the Commonwealth Foundation of bills signed reveals Gov. Josh Shapiro’s first six months were the least productive of any gubernatorial term in at least 50 years.

Fact Sheet

Read More: Shapiro’s First Six Months Least Productive Legislatively in 50 YearsEducation

Lifeline (PASS) Scholarship Program

Overview Lifeline Scholarships, also known as the Pennsylvania Award for Student Success (PASS) program, would offer an Education Opportunity Account (EOA) to any student residing in a school ranked in…

Fact Sheet

Read More: Lifeline (PASS) Scholarship ProgramEducation

Lifeline Scholarship Program

Overview Lifeline Scholarships (Senate Bill 795 and House Bill 1432) offer an Education Opportunity Account (EOA) to students residing in a school ranked in the bottom 15 percent…

Fact Sheet

Read More: Lifeline Scholarship ProgramRegulation

How Pa. Can Show it is Open for Business

Summary Pennsylvania’s economy is performing poorly with high unemployment, low labor force participation, and lackluster job growth. Roughly 40,000 residents left the state last year because of poor economic conditions…

Fact Sheet

Read More: How Pa. Can Show it is Open for BusinessEducation

Assisting Students in Economically Disadvantaged Schools

Overview The Economically Disadvantaged School component of the Educational Improvement Tax Credit (EITC) provides supplementary scholarships for Pennsylvania students receiving scholarships and attending private schools with the greatest financial need.

Fact Sheet

Read More: Assisting Students in Economically Disadvantaged SchoolsEducation

Education Choice Myths and Facts

School Choice Saves Money While Saving Kids School choice reforms are significantly less costly than average per-pupil spending at public schools, which is over $21,200.[1] In contrast, the…

Fact Sheet

Read More: Education Choice Myths and FactsEducation

Pa. Education Funding Spikes Again

Key Points Pennsylvania school district spending per student increased to $21,263 in 2021–22. State support of public education is up 55.7 percent over the last decade, reaching an all-time high…

Backgrounder

Read More: Pa. Education Funding Spikes AgainEducation

Education Opportunity Accounts in Practice

Key Points Education Opportunity Accounts (EOAs) are transformative, flexible-use accounts funded by state tax dollars.Program Administration: The Pennsylvania Treasury is the ideal administrator at the state level and may contract…

Backgrounder

Read More: Education Opportunity Accounts in PracticeHealth Care

Expanding Health Care Access: The Easy Way

Key Findings Full practice authority for nurse practitioners (NPs) would increase the amount of time NPs can see patients by about 45 minutes each week.This translates into almost one more…

Executive Summary

Read More: Expanding Health Care Access: The Easy WayPublic Union Democracy

HB 950: A Power Grab for Union Executives at the Expense of Workers

Summary House Bill 950 proposes an amendment to the Pennsylvania Constitution creating a “fundamental right to organize and bargain collectively” for both private and public sector employees.[1]The…

Fact Sheet

Read More: HB 950: A Power Grab for Union Executives at the Expense of WorkersPublic Union Democracy

Pennsylvania House Labor & Industry Committee Testimony on HB 950

Chairmen Dawkins and Mackenzie: Good afternoon. Thanks to Chairmen Dawkins and Mackenzie for the invitation to testify on this resolution, and thanks to the rest of the committee for your…

Testimony

Read More: Pennsylvania House Labor & Industry Committee Testimony on HB 950Welfare

Unwinding Medicaid Continuous Enrollment

Summary On April 1, Pennsylvania returned to normal Medicaid eligibility rules and began a year-long process of redetermining eligibility for all 3.68 million beneficiaries.Medicaid spending grows faster than our state…

Fact Sheet

Read More: Unwinding Medicaid Continuous EnrollmentEducation

Common Ground in the Commonwealth Poll Findings

Summary The Common Ground in the Commonwealth Poll, conducted March 24-29, is the first in a series of quarterly surveys taking the pulse of voters on the “state of the…

Memo

Read More: Common Ground in the Commonwealth Poll FindingsTaxes & Economy

Minimum Wage

Summary One percent of Pennsylvania workers earn the minimum wage, an all-time low.Gov. Josh Shapiro proposed raising the minimum wage to $15 an hour. Recent analysis by Pennsylvania’s Independent Fiscal…

Fact Sheet

Read More: Minimum WagePublic Union Democracy

Government Union Political Spending in the 2021–22 Election Cycle

Key Points Government unions are a top interest group in Pennsylvania, spending more than $190 million on politics since 2007. Government union political action committee (PAC) spending continues to increase,…

Backgrounder

Read More: Government Union Political Spending in the 2021–22 Election CycleEducation

Fiscal Impact of School Choice

Summary Tax credit scholarships and Education Opportunity Accounts (EOAs) provide students with educational opportunity at a fraction of what public schools cost, generating significant savings for taxpayers. Educational choice programs…

Fact Sheet

Read More: Fiscal Impact of School ChoiceTaxes & Economy

Tearing Down Barriers to Prosperity: How More Economic Freedom Can Reduce Poverty and Boost Prosperity in Pennsylvania

Key Findings Economic freedom, specifically lower government spending, strongly and consistently offers both increases in prosperity and reductions in poverty.States that gained economic freedom from 2010 to 2019 tend to…

Executive Summary

Read More: Tearing Down Barriers to Prosperity: How More Economic Freedom Can Reduce Poverty and Boost Prosperity in PennsylvaniaTaxes & Economy

Tearing Down the Barriers to Prosperity: What Pennsylvanians Say About Poverty and Prosperity

Unlike most reports on poverty, this report combines statistics, a survey of Pennsylvanians with income below 200 percent of the poverty line, and in-depth interviews to identify common barriers to…

Executive Summary

Read More: Tearing Down the Barriers to Prosperity: What Pennsylvanians Say About Poverty and ProsperityEnergy

Review of Regulation Constitutional Amendment

What is the Constitutional Amendment on Legislative Review of Regulations? This amendment would allow the legislature to reject a proposed regulation by passing a concurrent resolution with a simple majority…

Backgrounder

Read More: Review of Regulation Constitutional AmendmentEducation

Speaker Rozzi’s Listening Tour Testimony

Mr. Speaker and members of the working group, thank you for allowing Commonwealth Foundation to provide brief comments on the importance of the house returning to work. My name is…

Testimony

Read More: Speaker Rozzi’s Listening Tour Testimony