Latest Content

Education

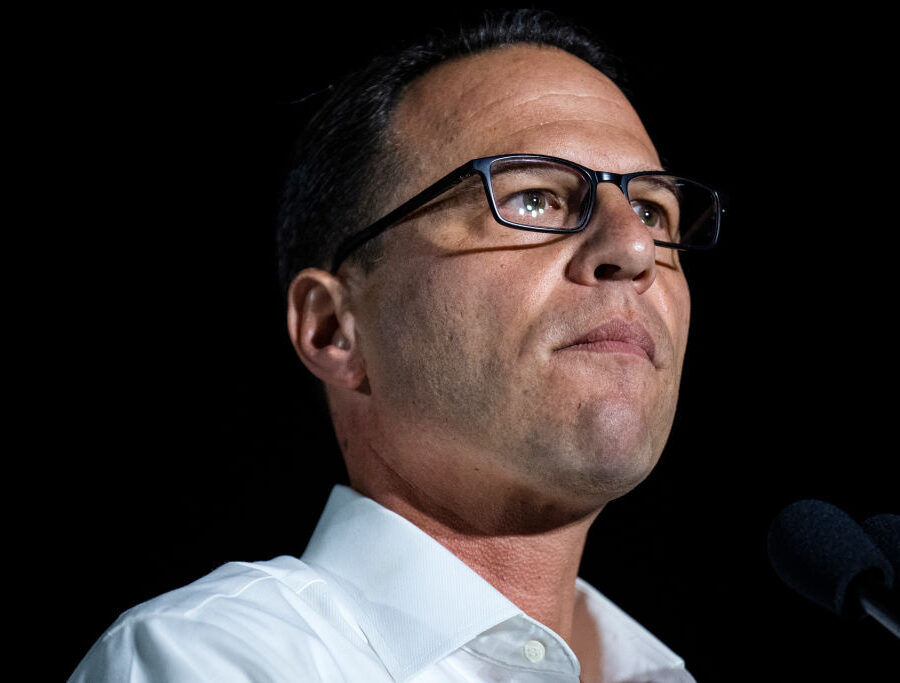

What You Need to Know About Pennsylvania’s 2025-26 State Budget

Summary Four months late, Gov. Josh Shapiro and state lawmakers agreed on a state budget deal. The agreement spends $1.4 billion less than Shapiro’s reckless, extreme proposal, and uses excessive…

Read More: What You Need to Know About Pennsylvania’s 2025-26 State Budget

Education

Josh Shapiro: Least Productive Pennsylvania Governor in at Least 50 Years

Read More: Josh Shapiro: Least Productive Pennsylvania Governor in at Least 50 Years

Education

Low-Achieving and Violent Public Schools in Pennsylvania

Read More: Low-Achieving and Violent Public Schools in Pennsylvania

Myths and Facts: Public Cyber Charter Schools

Read More: Myths and Facts: Public Cyber Charter SchoolsGovernment Accountability

Voter ID Constitutional Amendment

Key Points Voter ID requirements improve election integrity, while voter turnout increases, without impacting election outcomes.Pennsylvania voters support Voter ID requirements by a wide margin, with support across all regions…

Backgrounder

Read More: Voter ID Constitutional AmendmentEnergy

Assessing Gov. Tom Wolf’s Tenure

Key Points During Gov. Tom Wolf’s eight years in office, Pennsylvania ranked below the national average in income growth, job growth, and population growth.State government spending increased significantly under Wolf,…

Backgrounder

Read More: Assessing Gov. Tom Wolf’s TenureState Budget

Pennsylvania State Budget Outlook

In November, the Pennsylvania Independent Fiscal Office (IFO) released its Five Year Economic and Budget Outlook. Here are several trends for lawmakers. Pennsylvania’s Economy Remains Stagnant IFO forecasts Pennsylvania’s…

Fact Sheet

Read More: Pennsylvania State Budget OutlookEducation

Pa. Tax Credit Scholarships

Summary Pennsylvania awarded almost 63,000 K–12 scholarships, and the average overall scholarship increased to over $2,500 for the 2020–21 school year. In 2020–21, K–12 students in Pennsylvania submitted almost 139,000…

Fact Sheet

Read More: Pa. Tax Credit ScholarshipsHealth Care

The Case for Nurse Practitioner Reform: Full Practice Authority in Pennsylvania

Key Points More than 580,000 Pennsylvanians live in areas with a shortage of primary care professionals relative to the population. This shortage exists throughout the state but concentrates in rural…

Backgrounder

Read More: The Case for Nurse Practitioner Reform: Full Practice Authority in PennsylvaniaEnergy

Rising Electricity Costs

How High Are Electric Bills Rising? Electricity bills are rising across the commonwealth by an average of 73 percent between December 2020 and December 2022.Increases range from 55 percent for…

Fact Sheet

Read More: Rising Electricity CostsHealth Care

How Full Practice Authority Can Increase Access and Improve Outcomes

Key Findings Marylanders in border counties have better health care outcomes, including fewer residents reporting fair or poor health and fewer residents with poor mental health days.Before full practice authority,…

Report

Read More: How Full Practice Authority Can Increase Access and Improve OutcomesGovernment Accountability

Frequently Asked Q&A About Election Integrity in Pennsylvania

It’s time for all registered Pennsylvanians to exercise our civic duty and head out to vote on Tuesday, November 8th. With public opinion polls showing a lack of confidence…

Research

Read More: Frequently Asked Q&A About Election Integrity in PennsylvaniaWelfare

Pa’s Wayward Welfare State

Summary Policies that expanded Medicaid eligibility to healthy, working-aged people and do not require the verification of eligibility have expanded the size and complexity of a program designed to focus…

Fact Sheet

Read More: Pa’s Wayward Welfare StateEnergy

The Dangers of Environmental, Social, and Governance Mandates

*This testimony was requested by the House Commerce Committee for a hearing that did not occur.* Chairman Roae, Chairman Galloway and members of the House Commerce Committee, thank you for…

Testimony

Read More: The Dangers of Environmental, Social, and Governance MandatesPublic Union Democracy

Government Union Political Spending in the 2021–22 Election Cycle

Introduction According to campaign finance reports and union financial disclosure statements, Pennsylvania government unions have spent $169 million on politics since 2007, making government unions a top special interest in…

Fact Sheet

Read More: Government Union Political Spending in the 2021–22 Election CyclePublic Union Democracy

The Battle for Worker Freedom in the States: Grading State Public Sector Labor Laws

KEY POINTS In the four years following the Janus v. AFSCME U.S. Supreme Court ruling, the nation’s four largest government unions—AFSCME, SEIU, NEA, and AFT—have lost almost 219,000 union…

Report

Read More: The Battle for Worker Freedom in the States: Grading State Public Sector Labor LawsTaxes & Economy

Pa. Economic Trends September 2022

Overview Families across the country continue to feel the pressure of rising prices. The Consumer Price Index is up 8.3% over the last year, and while gasoline prices have fallen…

Backgrounder

Read More: Pa. Economic Trends September 2022

Pennsylvania Back-to-School Education Trends

As students head back to school, there are many claims of teacher shortages and funding shortfalls. In reality, public school spending is at a record high and Pennsylvania ranks among…

Research

Read More: Pennsylvania Back-to-School Education TrendsGovernment Accountability

New Numbers on Political Spending by Government Union Executives

Labor Day is a celebration of the American worker—their contributions and achievements that make this country great. Unfortunately, many American workers are sidelined—even bullied—by organizations that are meant to represent…

Memo

Read More: New Numbers on Political Spending by Government Union ExecutivesEducation

Pa. Back to School Education Trends

Overview As students head back to school, there are many claims of teacher shortages and funding shortfalls. In reality, public school spending is at a record high and Pennsylvania ranks…

Report

Read More: Pa. Back to School Education TrendsEnergy

Corporate Welfare, No Boost to Business Climate

Summary Pennsylvania’s economy continues to struggle. In June, Pennsylvania’s unemployment rate reached 4.5 percent, the fifth highest in the nation.[1], [2] As of June…

Fact Sheet

Read More: Corporate Welfare, No Boost to Business ClimateCriminal Justice Reform

Juvenile Justice Reform

Key Points The Pennsylvania Juvenile Justice Task Force (Task Force) found most youth entering the juvenile justice system committed low-level offenses and are “low risk to reoffend.”[1]Studies…

Backgrounder

Read More: Juvenile Justice ReformState Budget

What to know about the 2022 state budget deal

Pennsylvania lawmakers today unveiled the next fiscal year’s state budget plan. The Bad News: This budget represents excessive growth in government spending, increasing state spending by 10.7 percent over last…

Memo

Read More: What to know about the 2022 state budget dealHealth Care

Medicaid’s Endless Expansion

Key Points Medicaid enrollment has surged, increasing by more than one million since 2015.[1] The program now covers more than one-quarter of all Pennsylvanians.Medicaid is the largest program…

Backgrounder

Read More: Medicaid’s Endless Expansion

Teacher Union Collective Bargaining Agreements 4 Years Post-Janus

On June 27, 2018, the United States Supreme Court issued a landmark ruling in Janus v. AFSCME. The court ruled that public-sector employees no longer had to financially support a…

Memo

Read More: Teacher Union Collective Bargaining Agreements 4 Years Post-Janus