Latest Content

Education

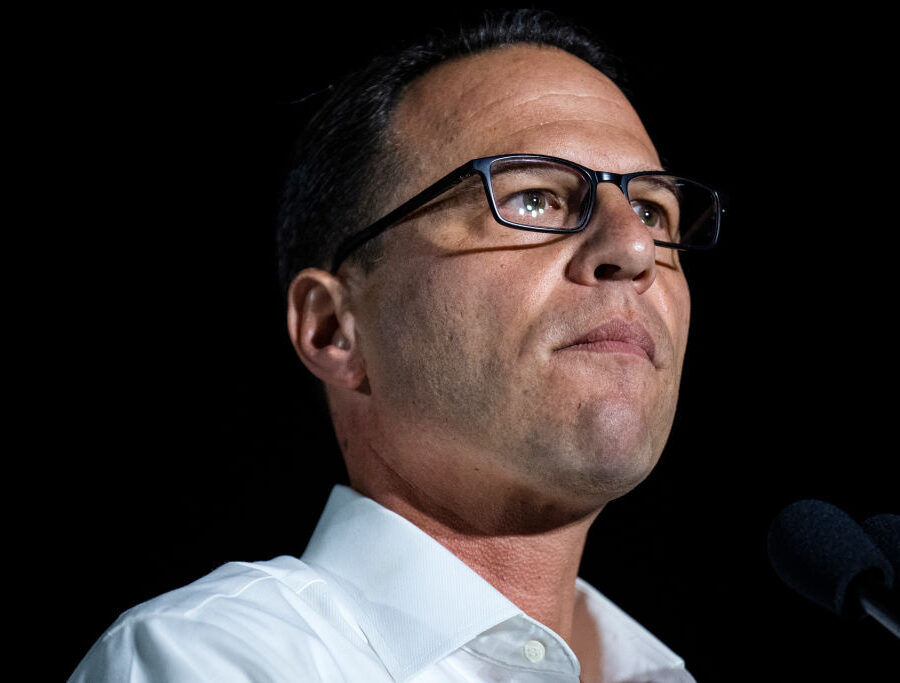

What You Need to Know About Pennsylvania’s 2025-26 State Budget

Summary Four months late, Gov. Josh Shapiro and state lawmakers agreed on a state budget deal. The agreement spends $1.4 billion less than Shapiro’s reckless, extreme proposal, and uses excessive…

Read More: What You Need to Know About Pennsylvania’s 2025-26 State Budget

Education

Josh Shapiro: Least Productive Pennsylvania Governor in at Least 50 Years

Read More: Josh Shapiro: Least Productive Pennsylvania Governor in at Least 50 Years

Education

Low-Achieving and Violent Public Schools in Pennsylvania

Read More: Low-Achieving and Violent Public Schools in Pennsylvania

Myths and Facts: Public Cyber Charter Schools

Read More: Myths and Facts: Public Cyber Charter Schools

A Brief History of Tom Wolf’s Tax Hike Proposals

Since taking office seven years ago, Governor Wolf has proposed or supported 14 tax hikes on working families.

Fact Sheet

Read More: A Brief History of Tom Wolf’s Tax Hike ProposalsState Budget

Supplemental Appropriations

Supplemental appropriation is another term for overspending. In theory, this practice covers unforeseeable expenses, but it has become a normal part of the state budget process.

Fact Sheet

Read More: Supplemental Appropriations

Public Sector Union 2020 Election Spending

Public sector union political action committees (PAC) spent $16.7 million in Pennsylvania during the 2019–2020 election cycle, principally on behalf of Democratic politicians.

Backgrounder

Read More: Public Sector Union 2020 Election SpendingState Budget

Opportunity Finds a Way

The 2018-19 budget increased EITC by $25 million, providing an additional 8,000 student scholarships. Each child deserves an exceptional education—one that fits their unique gifts and talents. Parents should have…

Fact Sheet

Read More: Opportunity Finds a Way

Steps to Enhance Election Integrity

In 2020, Pennsylvania’s newly amended election law struggled under unprecedented mail-in voting, yet last minute state guidance and judicial decisions not only skirted election law, but further delayed results and…

Fact Sheet

Read More: Steps to Enhance Election Integrity

Corporate Welfare in 3 Charts

The Governor’s Executive budget includes updated estimates for spending on corporate welfare, which is government favoritism of one sector or business over others. This favoritism is disquised under less innocuous…

Fact Sheet

Read More: Corporate Welfare in 3 Charts

School Reserve Funds in Pandemic Times

Pennsylvania school officials are projecting local tax revenue losses for the upcoming year due to the wreckage from COVID-19 restrictions. Even if local tax revenue declines, most schools have…

Backgrounder

Read More: School Reserve Funds in Pandemic Times

Caring for Kids and Communities: The 2021 State Budget

A successful recovery is not dependent on government aid; it requires education lifelines for families, regulatory and tax relief for small businesses, and health care reforms to bolster patient access…

Backgrounder

Read More: Caring for Kids and Communities: The 2021 State BudgetState Budget

The Taxpayer Protection Act

KEY POINTS Pennsylvania’s frequent budget deficits are the consequence of chronic overspending. Pennsylvanians pay $4,589 per person in state and local taxes, which equals 10.2 percent of residents’ total…

Backgrounder

Read More: The Taxpayer Protection Act

The Race to Rebuild: How Pennsylvania Can Bounce Back After COVID-19

Pennsylvanians continue to struggle amidst the COVID-19 pandemic and government restrictions. Small business owners face permanent closure, children’s schooling is in disarray, and job seekers have few prospects. Families need…

Report

Read More: The Race to Rebuild: How Pennsylvania Can Bounce Back After COVID-19State Budget

How to Balance the State Budget without Raising Taxes in a Pandemic

Reducing spending to reflect how the pandemic impacted state agencies and balance the budget without tax hikes or borrowing is the first step. Without additional structural spending changes laid out in…

Backgrounder

Read More: How to Balance the State Budget without Raising Taxes in a Pandemic

Are Public Schools Underfunded?

Pennsylvania spends more per student than the vast majority of states. Education spending has significantly increased over the past decade. Scroll down to see how much funding your district receives…

Fact Sheet

Read More: Are Public Schools Underfunded?Regulation

Help Restaurants by Privatizing the PLCB

Clearly, Gov. Wolf looks out of touch—and perhaps he knows it. Last week, following his veto, he released a proposal to waiver license fees collected by the Pennsylvania Liquor Control Board (PLCB)…

Fact Sheet

Read More: Help Restaurants by Privatizing the PLCB

And Then What? Reforms Beyond the Current Budget

In any case, the budget will get balanced. For Pennsylvanians, the real question is: “And then what?” Pennsylvania’s budget problems preceded the virus shutdown and will continue long after it without real reform. Listed below are areas where lawmakers…

Backgrounder

Read More: And Then What? Reforms Beyond the Current BudgetHealth Care

How to Vote in PA Q&A

Election Day is Tuesday, November 3. In Pennsylvania, voters are navigating how to cast their ballots during this pandemic era. …

Fact Sheet

Read More: How to Vote in PA Q&APublic Union Democracy

Protecting the Rights of Pennsylvania Public Employees

Key Points Pennsylvania state law grants unions exclusive bargaining rights in government workplaces, makes it difficult for workers to leave their union, and allows taxpayer collection of union political money.Through…

Backgrounder

Read More: Protecting the Rights of Pennsylvania Public Employees

Regulatory Reform: Three Ways to Jumpstart the Post-COVID Economy

At the beginning of April, over 80% of small businesses were at risk of closing if the shutdown continued for five more months. As of July, the U.S. Chamber of Commerce…

Backgrounder

Read More: Regulatory Reform: Three Ways to Jumpstart the Post-COVID Economy

How to Balance the Budget: Revenue Options

Pennsylvania’s partial-year budget to fund the government through November relied on federal emergency aid to patch a prospective deficit. The state cannot count on such extra resources in the future.

Backgrounder

Read More: How to Balance the Budget: Revenue OptionsHealth Care

Preserving Medicaid Before It’s Too Late

Pennsylvania’s Medicaid program is a national leader in all the wrong ways. Sub-standard access to care and soaring enrollment, costs, and fraud crowd out services for people with intellectual disabilities and low-income…

Backgrounder

Read More: Preserving Medicaid Before It’s Too LateHealth Care

COVID-19 Could Change the Way Pennsylvania Does Business

Small business owners like Elvira, Jessa, and Andy deserve a fighting chance to keep their business dreams alive. That’s the only way to heal Pennsylvania’s economy.

Fact Sheet

Read More: COVID-19 Could Change the Way Pennsylvania Does Business