Latest Content

Education

What You Need to Know About Pennsylvania’s 2025-26 State Budget

Summary Four months late, Gov. Josh Shapiro and state lawmakers agreed on a state budget deal. The agreement spends $1.4 billion less than Shapiro’s reckless, extreme proposal, and uses excessive…

Read More: What You Need to Know About Pennsylvania’s 2025-26 State Budget

Education

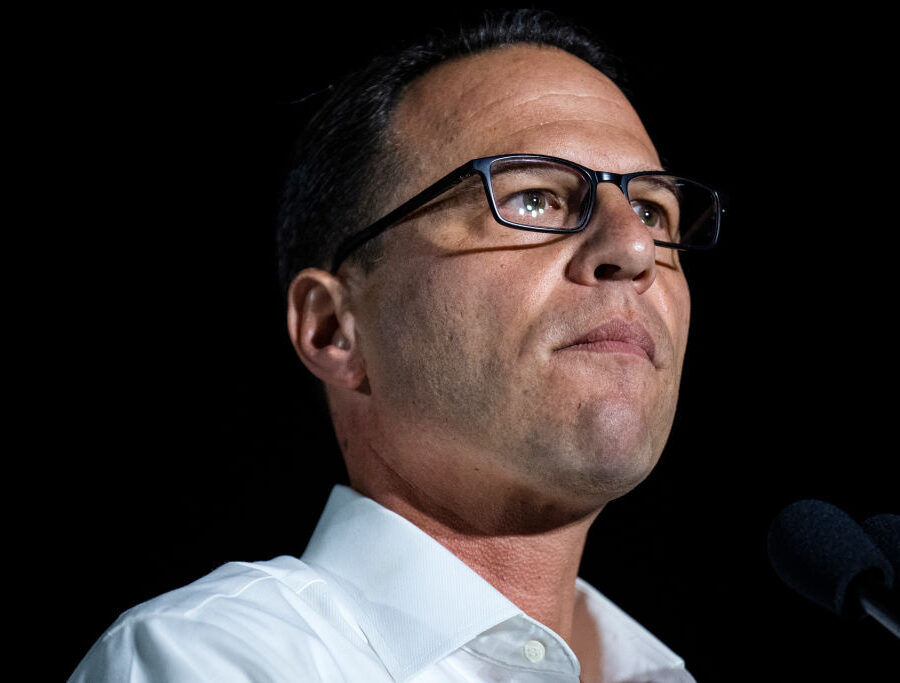

Josh Shapiro: Least Productive Pennsylvania Governor in at Least 50 Years

Read More: Josh Shapiro: Least Productive Pennsylvania Governor in at Least 50 Years

Education

Low-Achieving and Violent Public Schools in Pennsylvania

Read More: Low-Achieving and Violent Public Schools in Pennsylvania

Myths and Facts: Public Cyber Charter Schools

Read More: Myths and Facts: Public Cyber Charter SchoolsEnergy

Deficit Watch: April 2025

Improving Pennsylvania’s economy will help close the deficit. Background Pennsylvania faces serious fiscal challenges. The enacted 2024–25 General Fund budget created a $3.6 billion structural deficit.

Deficit Watch

Read More: Deficit Watch: April 2025Public Union Democracy

Protecting Public Employees’ Personal Information

Summary Government unions regularly obtain sensitive personal information from employers through their collective bargaining processes. Unions are not responsible stewards of this sensitive information. The Pennsylvania State Education Association (PSEA)…

Fact Sheet

Read More: Protecting Public Employees’ Personal InformationHealth Care

How to Help Pennsylvanians Prosper with Medicaid and SNAP Reform

Work requirements, strengthening eligibility verification, and prioritizing traditional enrollees will lead to better outcomes. Summary The Supplemental Nutrition Assistance Program (SNAP) and Medicaid programs are intended to help adults increase…

Fact Sheet

Read More: How to Help Pennsylvanians Prosper with Medicaid and SNAP ReformEducation

Shadow School Choice: When Public Schools Turn Students Away

Summary The School District of Philadelphia outsources special education to private schools when the district is unable to meet the student’s special education needs. The U.S. Department of Education guarantees…

Fact Sheet

Read More: Shadow School Choice: When Public Schools Turn Students AwayEnergy

IFO Data Shows Pennsylvania’s Emissions Success Story

The Keystone State is lowering emissions and generating more energy without RGGI or PACER taxes. Overview The Keystone State cut total emissions while increasing electricity generation, according to the two…

Fact Sheet

Read More: IFO Data Shows Pennsylvania’s Emissions Success StoryEducation

Pennsylvania Education Myths

Summary Conversations about education in Pennsylvania are fraught with myths, including the notions that Pennsylvania public schools remain underfunded, nonpublic options and school choice programs lack accountability, private schools only…

Fact Sheet

Read More: Pennsylvania Education MythsState Budget

Deficit Watch: March 2025

Background Pennsylvania faces serious fiscal challenges. The enacted 2024–25 General Fund budget created a $3.6 billion structural deficit. Gov. Josh Shapiro’s 2025–26 budget…

Deficit Watch

Read More: Deficit Watch: March 2025Education

Record Tax Credit Scholarship Waiting List Shows Growing Demand for Education Options

Summary Pennsylvania scholarship organizations awarded a record 85,570 K–12 scholarships through the Educational Improvement Tax Credit (EITC) and Opportunity Scholarship Tax Credit (OSTC) in the 2022-23 school year. The average…

Fact Sheet

Read More: Record Tax Credit Scholarship Waiting List Shows Growing Demand for Education OptionsState Budget

Optimizing State Spending

Summary Pennsylvania faces a $3.6 billion structural budget deficit in Fiscal Year (FY) 2024–25. The Independent Fiscal Office (IFO) calculates Gov. Josh Shapiro’s FY 2025–26 budget…

Fact Sheet

Read More: Optimizing State SpendingEducation

Pennsylvania Public Schools: Nation’s Report Card 2024

Summary Despite $4.1 billion in education funding increases over the last four years, Pennsylvania public schools did not rank in the top 10 for any category…

Fact Sheet

Read More: Pennsylvania Public Schools: Nation’s Report Card 2024State Budget

Deficit Watch: February 2025

Background Pennsylvania faces serious fiscal challenges. The enacted 2024–25 General Fund budget created a $3.6 billion structural deficit, with $47.6 billion in spending and only $43.9 billion in net…

Deficit Watch

Read More: Deficit Watch: February 2025Education

Governor Shapiro’s 2025 Budget Proposal: An Extreme Spending Binge

Overview Gov. Josh Shapiro’s radical overspending exacerbates what is already a massive budget deficit. His plan imposes new taxes this year and will force extreme tax hikes on working families…

Fact Sheet

Read More: Governor Shapiro’s 2025 Budget Proposal: An Extreme Spending BingeEducation

2025 State of Education Spending in Pennsylvania

Overview The national trends impacting education in Pennsylvania in 2025 include an impending fiscal cliff, under-enrolled schools, and population decline, all of which lead to school closures…

Backgrounder

Read More: 2025 State of Education Spending in PennsylvaniaState Budget

How to Balance the PA State Budget

Key Points Pennsylvania faces a $3.6 billion structural deficit in fiscal year (FY) 2024–25. Unless addressed, the deficit will require massive tax increases on working families by next year. Extreme…

Backgrounder

Read More: How to Balance the PA State BudgetEnergy

RGGI Is a Destructive Policy for Pennsylvania

Overview The Regional Greenhouse Gas Initiative (RGGI) is a multi-state cap-and-trade program that imposes a carbon tax on power generators, resulting in a new, economy-wide energy…

Fact Sheet

Read More: RGGI Is a Destructive Policy for PennsylvaniaState Budget

The Rainy Day Fund

Summary The Budget Stabilization Reserve Fund, commonly referred to as the Rainy Day Fund, is Pennsylvania’s largest budgetary reserve fund. Pennsylvania law dictates that lawmakers may only draw from the…

Fact Sheet

Read More: The Rainy Day FundState Budget

Deficit Watch: January 2025

Background Pennsylvania faces serious fiscal challenges. The enacted 2024–25 General Fund budget created a $3.6 billion structural deficit, with $47.6 billion in spending and only $43.9 billion in net…

Deficit Watch

Read More: Deficit Watch: January 2025Energy

State of RGGI: Past, Present, and Future

Key Points The Regional Greenhouse Gas Initiative (RGGI) is a multi-state cap-and-trade program that imposes a carbon tax on power generators, resulting in a new, economy-wide energy tax. Pennsylvania entered…

Backgrounder

Read More: State of RGGI: Past, Present, and FutureGovernment Accountability

Election Reform in Pennsylvania

Summary Ahead of the 2020 election, Pennsylvania allowed no-excuse mail-in voting for the first time. Officials overwhelmed with millions of ballot requests, last-minute state guidance, and litigation resulted in delayed…

Fact Sheet

Read More: Election Reform in PennsylvaniaState Budget

Pennsylvania’s Looming Budget Challenges

Summary Pennsylvania’s fiscal year (FY) 2024–25 state budget has created a $3.6 billion structural budget deficit. Without a major shift in direction, this deficit will persist and grow in future…

Fact Sheet

Read More: Pennsylvania’s Looming Budget Challenges